For those who’re a mum or dad planning on your baby’s future training, the price of faculty might be overwhelming. Based mostly on as we speak’s charges and assuming a 5% annual price improve, the entire price of attendance of 4 years at a public, four-year college might be almost $200,000 inside the subsequent 10 years.

However why is faculty so costly? Many elements are chargeable for driving costs up, from decreased state funding to larger demand for high-end campus facilities. Nonetheless, there are methods to decrease training prices and make faculty extra reasonably priced.

The Price of Faculty Has Steadily Elevated Little by Little Every Yr

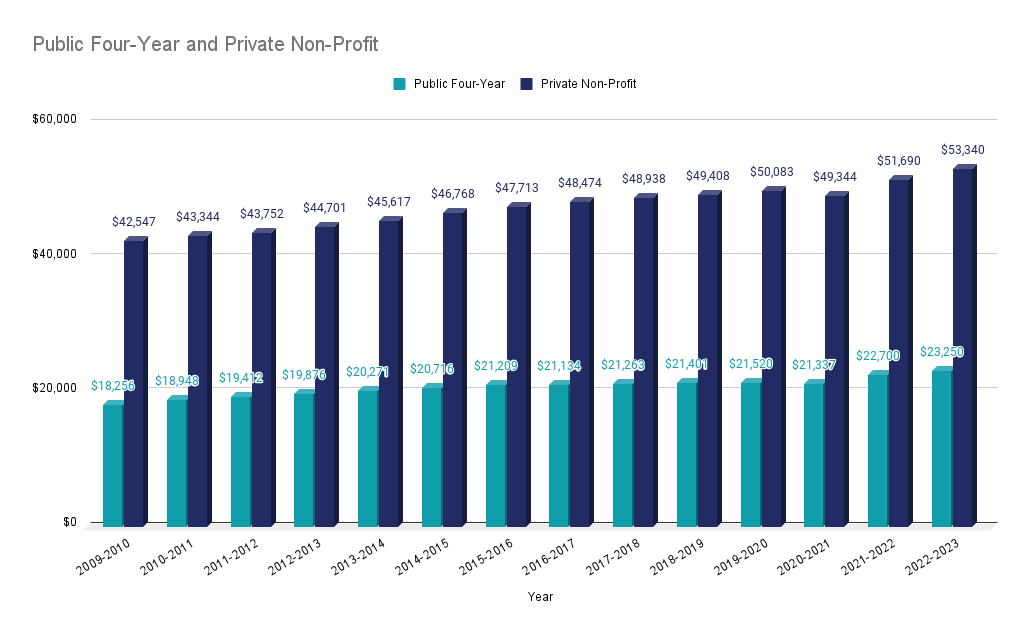

The price of faculty has elevated steadily over the previous couple a long time. Throughout the 2009-2010 tutorial 12 months, the typical price of tuition, charges and room and board was $18,256 at a public four-year college. For the 2022-2023 tutorial 12 months, that price was $23,250 — a 27% improve.

Personal faculties noticed related worth will increase. The typical price in 2009-2010 for a non-public non-profit college was $42,547. For the 2022-2023 tutorial 12 months, the associated fee elevated by 25% to $53,340, which is about the identical progress charge seen in public faculties.

These will increase are the results of small, incremental will increase annually to account for inflation, new facilities for college students, and up to date services to offer one of the best expertise potential for every scholar. We checked out all the the explanation why faculty has develop into costly through the years.

Causes Why Faculty is Costly

Why are faculties so costly today? There’s no single issue driving the rising costs. As an alternative, the value will increase are because of a number of contributing elements.

1. Inflation charges are excessive

Over the previous two years, inflation has been a serious concern. Inflation was over 9% in June 2022 and is now at about 5% — nonetheless above the federal government’s goal charge.

Excessive inflation makes the whole lot dearer. Colleges have substantial overhead prices, together with constructing upkeep, provides, landscaping, and meals. Their common bills are larger because of inflation, they usually cross a few of that price onto college students via larger tuition and costs.

2. Faculties spend extra on promoting and recruitment

After a long time of progress, the variety of college students going to school slowed lately. In reality, Inside Increased Ed reported that faculty enrollment numbers have fallen for 5 semesters in a row.

Declining enrollment means faculties should compete for incoming college students greater than ever. In consequence, they’re spending a major sum of money on promoting and recruitment efforts.

Collectively, faculties spend thousands and thousands annually on the whole lot from tv commercials to social media adverts and billboards. Colleges want to boost their tuition and costs to afford these promoting efforts.

3. Campus facilities are bettering

To draw new college students, many colleges constructed state-of-the-art scholar recreation facilities and different facilities. Contemplate these examples:

College of Missouri: Mizzou’s Tiger Grotto includes a zero-entry pool, sizzling tub, sauna, steam room, and a lazy river.

Excessive Level College: This campus has quite a lot of high-end facilities, together with an indoor monitor, a number of swimming pools (together with indoor ones), jacuzzies, ice rinks and eating facilities with choices from Subway, Chick-fil-A, and Starbucks.

College of Wisconsin-Madison: At this college, college students can hang around on the Sett Recreation Heart. It options perks like an precise bowling alley, a mountaineering wall, and pool tables.

These college perks aren’t that uncommon; extra faculties and universities are creating costly scholar facilities and dorms to attraction to new candidates and to make college students’ on-campus expertise comfy and pleasurable. In consequence, the price of attendance is far larger.

4. Colleges obtain much less cash from states

On the whole, states are spending much less on public faculties and universities than they did prior to now. The Nationwide Training Affiliation discovered that funding has declined by about $1,500 per scholar. To make up for the misplaced funding, faculties have elevated their tuition and costs, passing the associated fee to households.

5. Federal monetary assist has declined

Federal monetary assist is likely one of the commonest types of monetary help for faculty college students. Federal assist can come within the type of federal scholar loans, Pell Grants, and veterans’ advantages.

Nonetheless, federal monetary assist has considerably declined. Based on The Faculty Board, whole federal grant assist declined by 32% in inflation-adjusted {dollars} between the 2011-2012 and the 2021-2022 tutorial years. Pell Grants, a federal grant issued to low-income college students, declined by 36%, reducing by $14.6 billion.

With much less federal assist obtainable, faculties need to make up for a number of the shortfalls by providing their very own grants, scholarships and even institutional scholar loans — which add to the varsity’s bills.

7 Suggestions for Methods to Make Faculty Inexpensive

How can I make faculty cheaper? It’s a typical query. With these seven ideas, you possibly can decrease your training prices:

1. Attend group faculty

Group faculties price considerably lower than four-year faculties. By attending a group faculty for the primary two years of faculty and transferring to a four-year college to complete your diploma, you possibly can slash the price of a bachelor’s diploma.

2. Select an in-state public college — or search for a reciprocal program

An in-state public college will price half what a non-public college prices. Attending faculty inside the state the place you reside is one option to cut back your bills.

However if you wish to attend college out-of-state, take into account a public college that’s a part of a reciprocal community. Many states take part in networks that permit college students to go to high school in one other state however pay in-state tuition charges.

Yow will discover out in case your state participates in a tuition change or reciprocity program by visiting the Nationwide Affiliation of Pupil Monetary Assist Directors’ web site.

3. Submit the Free Utility for Federal Pupil Assist (FAFSA)

Not solely does the FAFSA aid you qualify for federal monetary assist, however faculties, states and non-profit organizations usually use it to find out your eligibility for different assist, together with grants and work-study applications.

Submit the FAFSA by the federal, state and faculty deadlines to get the utmost quantity of assist potential.

4. Analysis scholarships and grants

There are billions of {dollars} in grants and scholarships obtainable. They’re issued by non-profit organizations and personal firms everywhere in the nation, and you’ll apply for a number of awards and mix them to scale back your faculty prices.

Discover scholarship alternatives by looking out databases like FastWeb, Scholarships.com and The Faculty Board.

5. Contemplate a part-time job or aspect hustle

For those who can comfortably deal with your faculty coursework, getting a part-time job or aspect hustle can will let you earn cash to pay for a few of your bills, corresponding to your meals or textbooks.

Sources like SnagAJob and SideHustleNation can assist you discover jobs which are appropriate for a school scholar’s schedule.

6. Commute to high school

Though dwelling within the dorms might be interesting, faculty room and board might be costly. The price of your dorm and a school meal plan can add $10,000 to $15,000 per 12 months to your price of attendance.

In case your mother and father are prepared to have you ever reside at residence whilst you’re at school, it can save you a major sum of money by commuting to high school. Even if you happen to pay your mother and father hire, dwelling at residence might be less expensive than dwelling on campus.

7. Apply for personal scholar loans

In case your monetary assist bundle isn’t sufficient to cowl the total price of attendance, you should utilize personal scholar loans to pay for the remaining steadiness. As a school scholar, chances are you’ll not meet the necessities for a non-public mortgage since you don’t have a full-time job or established credit score historical past. However you possibly can enhance your probabilities of getting a mortgage — and qualifying for a aggressive rate of interest — by asking a mum or dad, relative or buddy to cosign the mortgage.

Planning for faculty bills

Now that you recognize why faculty is so costly, you can begin arising with a plan to pay for varsity. Whereas faculty prices are larger than they had been prior to now, you can also make the expense extra manageable by exploring your monetary assist choices, selecting a public in-state college and making use of for grants and scholarships.

Study Extra: A Full Information to Scholarships for Faculty College students