Because of Nigel Farage’s latest public spat with Coutt’s Financial institution and its dad or mum NatWest, the truth that individuals within the UK are with out entry to a checking account has turn out to be large information not too long ago.

The Monetary Conduct Authority (FCA), charged with documenting individuals’s entry to credit score and banking, issued its Monetary Lives 2022 report on 23 July this yr, which gives an summary of who’s falling by way of the cracks of the UK’s monetary providers sector.

Unbanked

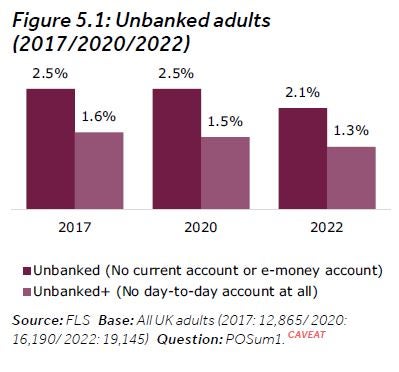

What we’ve discovered is that there are round 1.1 million adults within the UK at the moment dwelling their lives “unbanked”, who signify 2.1% of the nation’s grownup inhabitants, which is down from 1.3 million (2.5%) in 2017.

The modest decline from 2017 could look like a excellent news story, however it’s value remembering that companies throughout the UK have been going cashless at an important price for the reason that outbreak of Covid in 2020, which implies it has turn out to be even tougher to depend upon money alone not too long ago.

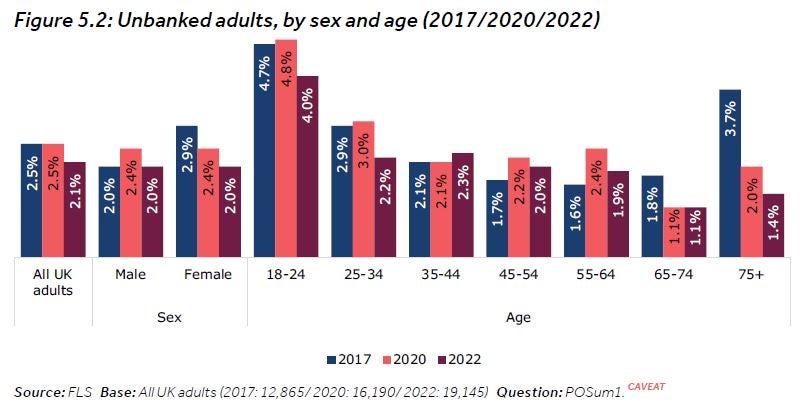

Discrimination based mostly on intercourse appears much less crucial than age in case you are unbanked too.

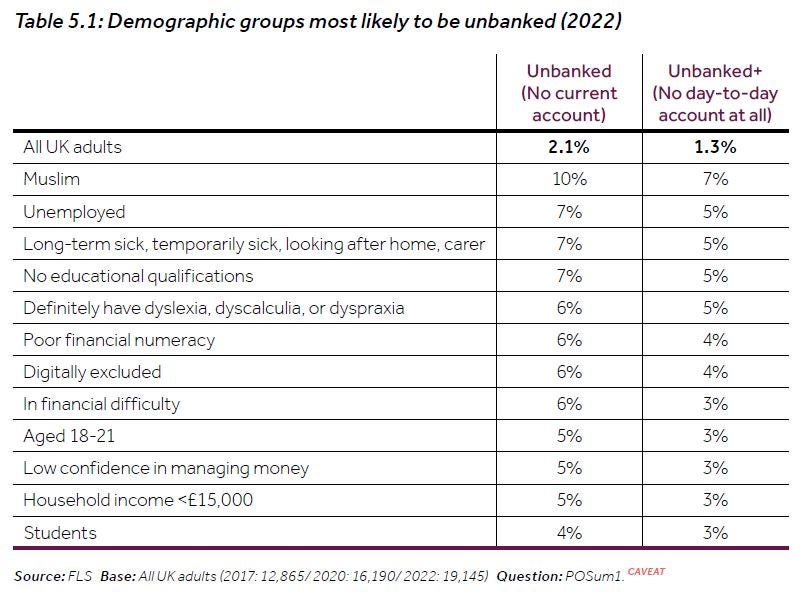

And, as we’d anticipate, some socially marginalised teams are additionally counting themselves among the many economically deprived.

In keeping with the FCA, the teams most certainly to be unbanked are Muslims (10%), the unemployed (7%) and those that had been long-term sick, briefly sick, taking care of the house, or carers (7%). In the meantime, these with no academic {qualifications} (7%) and those that have studying difficulties (6%) are additionally prone to be unbanked.

The place you reside can also be related to monetary vulnerability. Areas with the next proportion of unbanked adults are in Southern Scotland (6%), Outer London – West and North West (5%), Higher Manchester (4%), and the West Midlands (4%).

There’s additionally a robust hyperlink to deprivation, as 3.6% of adults in essentially the most disadvantaged areas of the UK are unbanked, in contrast with lower than 0.6% within the least disadvantaged areas.

Motor finance

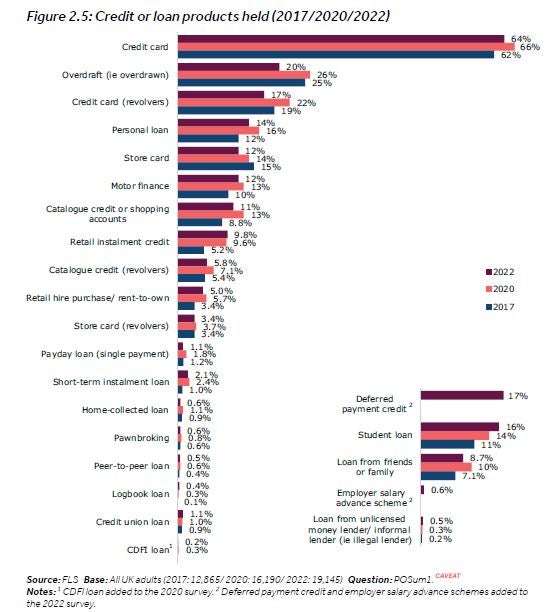

In terms of credit score and debt holding among the many UK grownup inhabitants. The FCA discovered that 83% of adults (44.0m) held not less than one credit score or mortgage product in May2022 (or had accomplished so within the earlier 12 months).

Probably the most extensively used credit score merchandise are overdrafts, bank cards, private loans and retailer playing cards. Motor finance merchandise got here quickly after, utilized by 12% of all UK adults in Might 2022, which was 13% in 2020 and 10% in 2017.

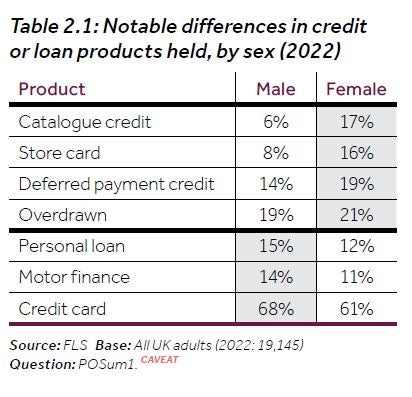

Of those credit score holders, males had been extra doubtless to make use of motor finance.

The report discovered that, in complete, 12.1 million adults (23% of all UK adults) had points accessing a monetary services or products within the two years to Might 2022, both as a result of 1) they had been refused service or product (3.8 million adults; 7% of adults), 2) determined the phrases or circumstances had been unreasonable (5.2 million adults; 10% of adults) or 3) prevented making use of altogether (6.8 million adults; 13% of all UK adults) as a result of they felt they’d not be eligible or felt they might not afford it or would have their purposes turned down.

Of those that had been refused a monetary services or products (7%), ladies had been extra prone to be turned down, however different demographic variations had been additionally famous based mostly on intercourse, age, ethnicity and employment standing.

Nearly one in 4 (24%) adults who utilized for a number of credit score or mortgage merchandise had been declined. The very best refusal charges had been amongst these making use of for different loans or credit score merchandise (ie, payday loans, brief‑time period instalment loans andpawnbroking loans), with 7% of candidates denied a motor finance product and 1% who had been declined motor insurance coverage protection for this era.

‘AI can be promoting vehicles by 2025’ — Phryon

How expertise may help determine monetary vulnerability