Breadcrumb Path Hyperlinks

Actual EstateCommercial Actual Property

Chapter comes at a tumultuous time for workplace actual property markets, however specialists anticipate the general influence shall be fleeting

Article content material

The chapter of office-sharing large WeWork Inc. is casting one other shadow over Canada’s beleaguered industrial actual property market, however business watchers anticipate the general influence shall be fleeting.

Based in 2010 and as soon as valued at US$417 billion, WeWork revealed on Nov. 6 that it has begun a considerable restructuring course of, together with a Chapter 11 chapter submitting within the U.S. and plans for recognition proceedings in Canada.

Commercial 2

Article content material

Article content material

The corporate mentioned in a launch that it had assist from key stakeholders for a restructuring that may “drastically cut back its current funded debt” and improve its monetary stability.

WeWork chief govt David Tolley informed the Related Press in an announcement that below the brand new settlement, roughly US$3 billion of the corporate’s debt is anticipated to be eradicated. The corporate’s chapter filings indicated it had liabilities of US$18.65 billion and belongings of US$15.06 billion as of June. Lease liabilities, representing roughly two-thirds of WeWork’s working bills, stay the corporate’s principal monetary impediment.

The chapter comes at a tumultuous time for workplace actual property markets, which have seen vacancies surge within the wake of the pandemic, as work-from-home and hybrid work preparations have develop into entrenched.

Downtown Toronto’s whole workplace emptiness price hit 15 per cent within the third quarter of 2023, based on actual property and funding administration agency Jones Lang LaSalle Inc. Previous to the pandemic, within the third quarter of 2019, that determine was two per cent.

Article content material

Commercial 3

Article content material

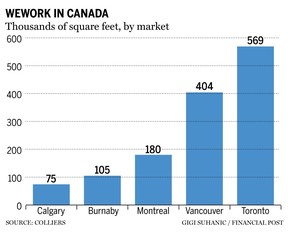

As a part of WeWork’s restructuring, the corporate mentioned it’s seeking to abandon 69 leases, together with two in Toronto, two in Vancouver and one in Burnaby, B.C. Forty of the leases it’s looking for to terminate are situated in New York. The corporate mentioned all members impacted by the modifications had been notified upfront of the U.S. chapter submitting.

In keeping with a report by industrial actual property providers and funding firm CBRE, WeWork expanded quickly in Toronto after launching its first website in 2017. Inside two years it had a dozen places encompassing 657,000 sq. toes, a six-fold improve.

Then in 2020, it unveiled its largest Toronto department, occupying two flooring on the Hudson’s Bay Co. constructing at Yonge and Queen, reverse the Eaton Centre, following a $1 billion cope with HBC.

Tobin Davis, vice chairman gross sales consultant at Colliers Canada famous that whereas lease liabilities pose a big problem for WeWork, any vacancies ensuing from their exit will signify a minor fraction of the Canadian market.

“Co-working house solely represents 1.1 per cent of the general nationwide stock of workplace house,” Davis mentioned. “The fact is we’re solely speaking about one participant proper? There’s nonetheless (roughly) 6.6 million sq. toes of co-working house by itself. The general well being of co-working house nonetheless stays robust.”

Commercial 4

Article content material

In keeping with Colliers, WeWork solely makes up roughly 0.5 per cent of the overall workplace house in Toronto.

Davis believes that regardless of the chapter, most of WeWork’s areas will stay co-working places, with landlords deciding on new operators going ahead.

“Nearly all of the house will nonetheless most likely stay as co-working house. (WeWork’s) enterprise mannequin failed. I believe they had been simply so centered on taking giant leases in city markets in occasions of upper actual property prices and it caught as much as them.”

Associated Tales

Downtown survived the Nineteen Eighties — and it’ll survive the 2020s

Hines thinks the workplace must be greater than only a place to work

Business actual property lending larger danger than beforehand thought

In 2020, The Higher Toronto Space (GTA) had roughly 3.14 million sq. toes of shared workspace, accounting for 1.8 per cent of its whole workplace house. Within the downtown core, shared workspaces encompassed 2.32 million sq. toes, making up 2.4 per cent of the realm’s workplace stock. Nationally, Canada’s marketplace for shared workspaces was roughly 6.1 million sq. toes.

A press launch on the WeWork web site states that whereas the corporate has not but commenced authorized proceedings in Canadian courts, it plans to file for recognition proceedings below Half IV of the Corporations’ Collectors Association Act.

• Electronic mail: [email protected]

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material

Share this text in your social community