America’s ecosystem of over 4,500 banks is an anomaly within the world panorama. Different international locations’ banking numbers barely attain 500. Nevertheless, banking has been going by means of a shift, and in 2023, the risk to smaller banks is rising.

Within the 2023 Cornerstone Advisors “What’s Going On in Banking” survey, threats have been registered from all sides. Whereas the notion of hazard from challenger banks has decreased, massive tech, fintechs, and “megabanks” make up an ever-present hazard within the minds of financial institution executives.

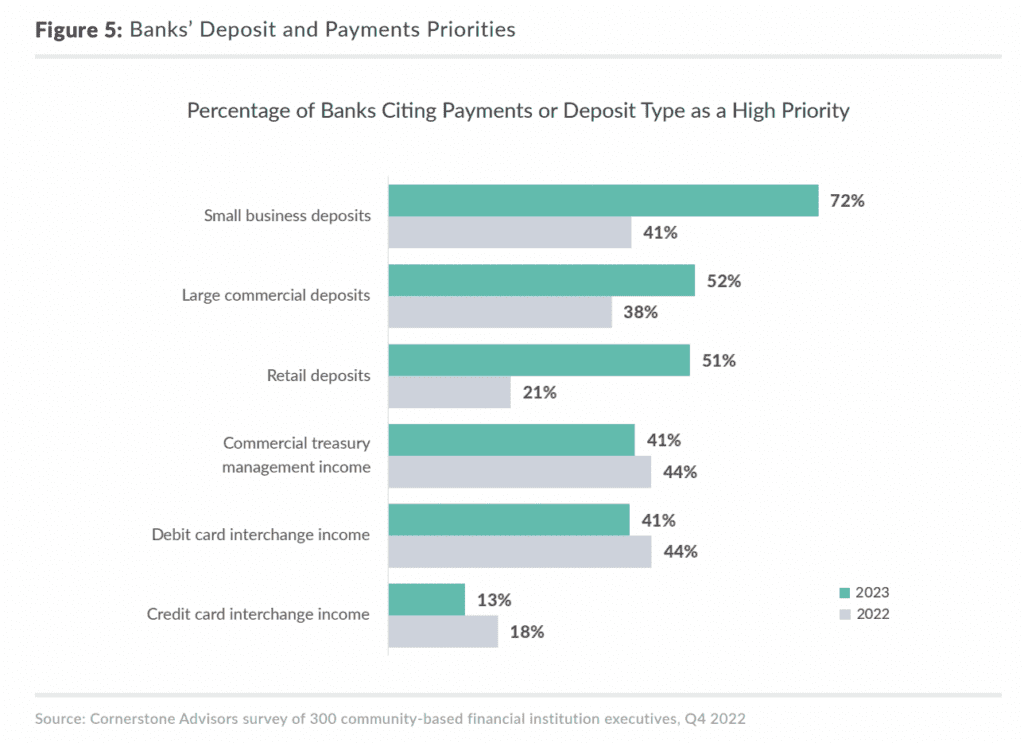

Deposit declines have been seen since mid-2022 and heightened drastically by the March banking disaster. Scooped up by the megabanks, small establishments have been left with an pressing want to alter their method. Cornerstone discovered that banks’ best precedence in 2023 had shifted considerably to rising their deposits. A digital account opening technique is turning into a crucial part.

Said to have “higher economics and enterprise fashions,” fintechs have the agility to deal with digital growth. Unbounded by most of the restrictions posed by banking license compliance, they will reply shortly to the speedy evolution of shopper calls for and tech.

The partnership between fintechs and banks may due to this fact be highly effective to spice up deposits.

Not only a one-way relationship

With round 272 million accounts, “mega fintechs” now service almost each grownup American beneath 55 with a smartphone. Fifteen million of those customers now take into account the fintechs their major spending or checking account supplier.

To not be confused with neobanks or “challenger” banks – they don’t maintain a banking license and infrequently associate with banks for providers to enhance their providing. In return for digital agility, fintechs, of their partnership with banks (be it a singular financial institution or a community), are supplied with a regulated custodian of buyer funds.

This may be notably highly effective for funds and financing suppliers, offering them with a banking infrastructure again finish that’s totally compliant with rules and insured by the FDIC. In the meantime, fintechs can work on growing progressive options that reply to buyer wants.

RELATED: USA 2023: Why fintechs shouldn’t change into banks

Nevertheless, based on Treasury Prime, an embedded banking platform that connects banks and fintechs, “Discovering a single financial institution that completely aligns with the necessities of a rising enterprise may be difficult…Partaking with a number of banks grants organizations the liberty to select from various choices that greatest go well with their evolving wants.”

The necessity to associate with a number of banks might have additionally been compounded by the March banking disaster. Using diversification by means of partnering with quite a few banks covers fintechs for attainable disruption in banks’ service.

“It’s extraordinarily vital to create financial institution redundancies to keep away from any potential outages that might affect your small business operations,” stated Treasury Prime CEO Chris Dean. The corporate defined that whereas none of Silicon Valley Financial institution’s consumer deposits have been misplaced, the financial institution’s failure had considerably disrupted the operations of fintechs that used them.

Treasury Prime companions with Academy Financial institution

Treasury Prime has labored to facilitate the partnership between fintechs and banks, creating an ecosystem to spice up innovation. As we speak, July 31, the corporate has introduced its collaboration with Acadamy Financial institution.

“Academy Financial institution’s potential to service deposit prospects in a extremely personalised method… varieties a robust basis for our partnership,” stated Jeff Nowicki, VP of Banking at Treasury Prime.

Within the announcement, it was said that the partnership with the financial institution “will empower companies to quickly launch and scale their cost and deposit merchandise, driving sturdy buyer engagement and retention.”

Academy Financial institution’s collaboration with Treasury Prime permits the establishment to energy elevated innovation with their deposits. The financial institution will open out its deposit providers to fintechs on the platform, permitting them to supply FDIC-insured accounts to their prospects.

“This collaboration aligns completely with our dedication to innovation and deal with the fintech trade,” stated David Robinson, Director of Fintech Partnerships at Academy Financial institution. “By leveraging Treasury Prime’s expertise, we will improve our choices and supply our fintech companions with the instruments they should speed up their progress and ship progressive monetary providers.”