Within the quickly evolving world of blockchain and cryptocurrencies, having a stable tokenomics mannequin is not simply a bonus; it’s an absolute necessity.

Startups and rising companies that fail to design a strong tokenomics mannequin threat shedding the curiosity of traders, affected by poor person adoption, and in the end, going through the collapse of their tasks. The implications of overlooking this significant side of blockchain tasks may be dire, resulting in wasted assets, broken reputations, and even full enterprise failure.

However how will you, as a startup or an rising enterprise, navigate the complexities of tokenomics and make sure the profitable implementation of a token economic system that fuels development, incentivizes person conduct, and stays sustainable in the long term?

The reply lies in understanding the important thing ideas, greatest practices, and challenges of tokenomics, in addition to studying from the successes and failures of different tasks within the area.

At Bitbond, we’ve seen our fair proportion of token designs being carried out by startups utilizing TokenTool.

On this complete information, we’ll dive deep into the world of tokenomics, equipping you with the information and instruments essential to design and implement a thriving token economic system to your blockchain undertaking.

By the top of this information, it is possible for you to to keep away from the pitfalls and maximize the potential of your undertaking by mastering the artwork and science of tokenomics.

Definition of Tokenomics

Tokenomics, also called token economics, refers back to the examine and design of financial programs inside blockchain-based tasks, specializing in the creation, distribution, and administration of digital tokens. Tokenomics performs a important position in figuring out the success and sustainability of a undertaking by driving person adoption, incentivizing desired behaviors, and making certain a undertaking’s long-term viability.

Significance of Tokenomics

Tokenomics is an important side of any blockchain undertaking because it serves as the inspiration of a undertaking’s financial construction. Whether or not you resolve to go together with an ICO or an IDO to launch your token, a well-designed tokenomics mannequin can:

Encourage person adoption and retention

Create and keep a wholesome, self-sustaining ecosystem

Appeal to traders and funding

Present a method for worth change and incentivization inside the platform

Instance: Bitcoin’s Tokenomics

Bitcoin is the world’s first and most well-known cryptocurrency, with a tokenomics mannequin centered round a hard and fast provide and a deflationary emission schedule. There are solely 21 million bitcoins that can ever be created. As extra bitcoins are mined, the speed at which new cash are launched decreases, creating shortage, and driving up the worth of the prevailing provide. This mannequin has been profitable in attracting traders and inspiring long-term holding, leading to a steadily growing worth over time.

Options of Tokenomics

There are a number of key options to contemplate when designing tokenomics for a undertaking, every with its implications and trade-offs.

Restricted Provide Vs. Limitless Provide

Tokens may be designed with a restricted or limitless provide. Restricted provide tokens have a hard and fast cap on the entire variety of tokens that can ever be created, whereas limitless provide tokens would not have a predetermined cap.

Consensus Mechanism

A consensus mechanism is a course of by which a blockchain community agrees on the validity of transactions and provides new blocks to the chain. Frequent consensus mechanisms embody Proof of Work (utilized by Bitcoin), Proof of Stake (utilized by Ethereum), and Delegated Proof of Stake.

Every mechanism has its strengths and weaknesses when it comes to vitality effectivity, safety, and decentralization. Consensus mechanisms are options of layer 1 blockchains, so should you want to create an Ethereum-based token, then you definately received’t want a consensus mechanism for it.

Token Utility

Token utility refers back to the varied capabilities and functions {that a} token serves inside its ecosystem.

Examples of token utility embody

Medium of change for items and providers

Entry to platform options or unique content material

Governance and voting rights inside the undertaking

Staking and incomes rewards

Token Burns

contain the intentional removing of tokens from circulation, sometimes by sending them to an inaccessible tackle or “burn” tackle. Token burns can be utilized to:

Cut back the general token provide, growing shortage and probably driving up the worth

Fight inflationary pressures

Present a deflationary mechanism for platforms with limitless token provides

Reward long-term holders and traders by lowering the circulating provide

Token Distribution, Lock-up & Vesting

Token distribution is the method by which tokens are allotted to varied stakeholders, together with staff members, traders, and customers. It’s important to have a good and clear distribution to encourage belief and confidence within the undertaking. Lock-up intervals and vesting schedules can assist align incentives, making certain that stakeholders stay dedicated to the undertaking’s long-term success.

Lock-up intervals are predetermined time frames throughout which tokens are inaccessible or non-transferable, typically used for staff tokens or early investor tokens.

Vesting schedules, however, regularly launch tokens to their recipients over time, serving to to stop sudden sell-offs and keep token worth stability.

Recreation Idea

Recreation principle, a elementary mechanism underlying many applied sciences, is the systematic examine of decision-making processes and the reasoning behind them. By using mathematical fashions of battle and cooperation, recreation principle seeks to grasp the conduct of decision-makers in varied conditions.

Within the context of cryptocurrencies, recreation principle permits builders to guage the decision-making processes of stakeholders inside an interactive setting.

Strategic parts in tokenomics design can bolster the demand for a token. Lock-up mechanisms, for instance, have confirmed to be an efficient software of recreation principle in tokenomics.

Such mechanisms incentivize token holders to lock their tokens in a contract, rewarding them with elevated returns. The Curve protocol demonstrates this idea, as customers lock their CRV tokens to obtain a share of the income.

The longer the tokens are locked, the upper the earnings. This creates a powerful incentive for stakers to maintain their tokens locked, contributing to the soundness and long-term success of the undertaking.

Good Indicators Vs. Unhealthy Indicators

When evaluating a undertaking’s tokenomics, it’s important to search for each constructive and destructive indicators of the undertaking’s potential success.

Good Indicators

Safety Audits: Common safety audits by respected corporations point out a dedication to sustaining a safe and dependable platform.

Present Consumer Base: A robust and rising person base demonstrates person curiosity and adoption, a important issue to have earlier than launching a token and setting it up for long-term success.

Token Disclosures: Clear details about token distribution, lock-up intervals, and vesting schedules fosters belief and credibility.

Unhealthy Indicators

Unfair Distribution: A closely skewed token distribution favoring the staff or a small group of traders can point out a scarcity of dedication to equity and decentralization.

No Actual Use Case: Tokens with out a clear use case or utility inside their ecosystem might battle to draw customers and keep worth.

Opaque / Unclear Launch Schedule: A scarcity of transparency about token launch schedules and distribution can point out potential manipulation or hidden agendas.

UniSwap and Compound’s Tokenomics: A Transient Comparability

Each UniSwap and Compound are standard DeFi platforms, however they’ve distinct tokenomics fashions.

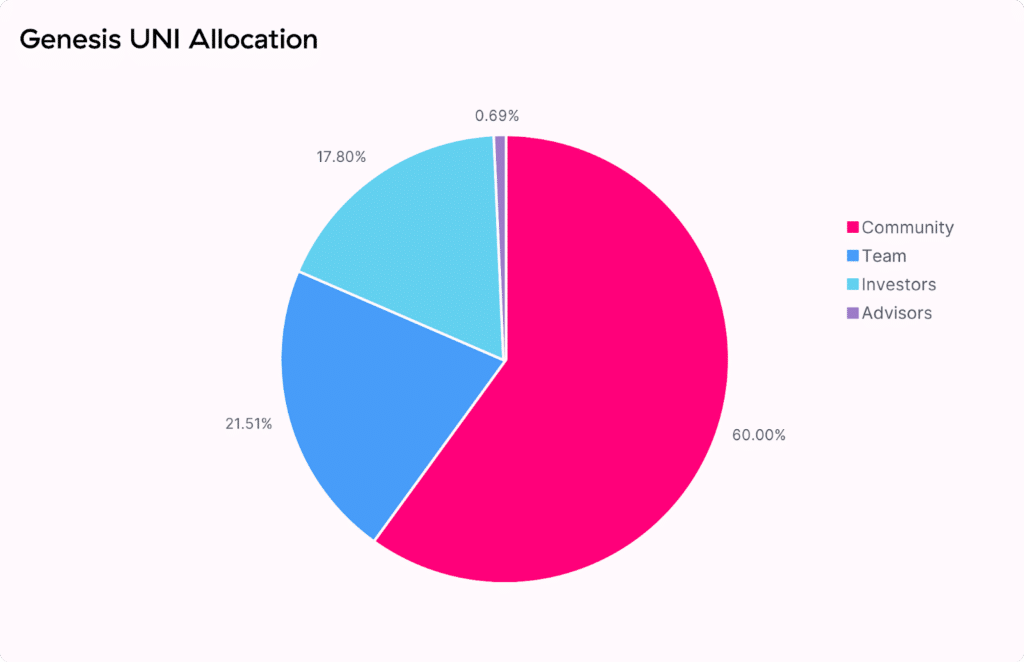

UniSwap’s native token, UNI, primarily serves as a governance token, permitting holders to take part within the platform’s decision-making course of. Token distribution was closely centered on rewarding early customers and liquidity suppliers, with 60% of the entire provide allotted to the group. UNI has no inflationary or deflationary mechanisms, counting on its governance and utility to drive worth.

Compound, however, has a dual-token system with the governance token COMP and cTokens, which symbolize a person’s share in a particular lending market. The platform has a extra advanced tokenomics mannequin, with distribution primarily centered on incentivizing borrowing and lending on the platform. Compound additionally employs a token-burning mechanism, including a deflationary side to its token economics.

Way forward for Tokenomics

Tokenomics will proceed to play a significant position within the success and sustainability of blockchain tasks. Because the trade evolves, tasks should regularly refine and optimize their tokenomics fashions to remain aggressive and supply worth to customers, traders, and different stakeholders.

Token design and human psychology are inheritably associated. A meaningfully designed token economic system considers the motives and desires of people prepared to take part in that ecosystem and goals to foretell person behaviors that end result from options inside the ecosystem. Startups and rising companies coming into the blockchain area should totally perceive the important thing ideas, greatest practices, and challenges related to tokenomics to maximise their possibilities of success. Therefore why it is strongly recommended to seek the advice of with an professional to just be sure you are setting your token mannequin proper for achievement.