A tokenization platform gives Tokenization-as-a-Service and thus permits customers to create tokens of various token requirements. Customers can simply difficulty digital tokens on blockchain, with out the need to be proficient in good contract programming. Along with token creation capabilities, tokenization platforms additionally present lifecycle administration providers to your tokens.Institutional and retail buyers, in addition to monetary establishments, use asset tokenization platforms to watch, difficulty, and handle their investments. As soon as belongings are tokenized, they can be utilized for world transactions with out the necessity for an middleman. Subsequently, customers can create liquidity for asset lessons of every kind on a worldwide scale utilizing a tokenization supplier.

What’s asset tokenization?

Asset tokenization refers back to the strategy of issuing safety tokens that characterize actual tradable belongings. It’s potential to tokenize any belongings together with VC funds, collectables, bodily items, actual property, treasured metals, and mental property. Tokenization is commonly mistaken for securitization. Whereas securitization entails pooling illiquid asset lessons and repackaging them into securities, asset tokenization converts actual world belongings into digital tokens.

Advantages of utilizing an asset tokenization platform

The first benefit of utilizing a tokenization platform is that customers can profit from the alternatives of asset tokenization. Benefits of asset tokenization usually are primarily improved liquidity, price financial savings, actual time transactions, transparency, and immutability.

The central advantages of utilizing an asset tokenization platform for the issuance and administration of tokens are good contract safety, no programming abilities are required, and effectivity. As Token Device’s good contracts are audited by Certik, there are fewer dangers of coding errors. Furthermore, all functionalities of Token Device might be simply utilized by customers with out being proficient in technical know-how. As a result of consumer friendliness of tokenization platforms resembling Token Device, crypto tokens might be issued inside minutes, making the method very environment friendly.

Moreover, organizations that intention at utilizing asset tokenization however lack technical information can use asset tokenization platforms to effortlessly create, distribute, and promote their tokens. No technical integration is required for web3 tokenization platforms as customers merely join with their wallets to the web-based platform. It spares them the necessity to spend a major quantity of sources on growing their very own good contracts and tokenization merchandise. Tokenization platforms permit organizations to profit from trade grade software program at an reasonably priced worth and far instantaneous deliverability.

Asset tokenization usually improves liquidity significantly for illiquid non-fungible belongings and personal securities. Because the fractionalization of possession prevents smaller buyers from being priced out, the funding base of an asset is expanded. Moreover, digital belongings might be traded 24/7 available on the market.

One other advantage of asset tokenization is decreased prices. As intermediaries might be eradicated, there’s a discount of buying and selling spreads and transaction prices are cheaper. Furthermore, asset tokenization helps actual time transactions which permit for fast and environment friendly peer-to-peer transactions.

Because the rights and obligations of the token holder are specified within the good contract that describes the token’s traits, transparency is assured. The information that’s recorded on a blockchain can’t be eliminated, modified or amended and is thus unchangeable.

Dangers related to asset tokenization platforms

The dangers related to asset tokenization platforms primarily seek advice from the dangers of all tokenized securities. Market costs for tokenized belongings could also be extremely variable and might considerably derive from the honest worth of an asset. Different dangers associated to asset tokenization are regulatory modifications, cyber-attacks and crypto heists.

Much like personal fairness and debt investments, the credit score and counterparty danger of investing in tokenized belongings could also be important. Furthermore, operational dangers of asset tokenization are that when funds are despatched to a specified blockchain handle, the transaction is irreversible.

A danger particularly associated to asset tokenization platforms is that they often depend on open-source software program for improvement functions and thus customers could encounter theft of tokenized belongings or programming errors. Nonetheless, these dangers are decreased if the asset tokenization platform commits to a sensible contract audit.

Tokenization platform options

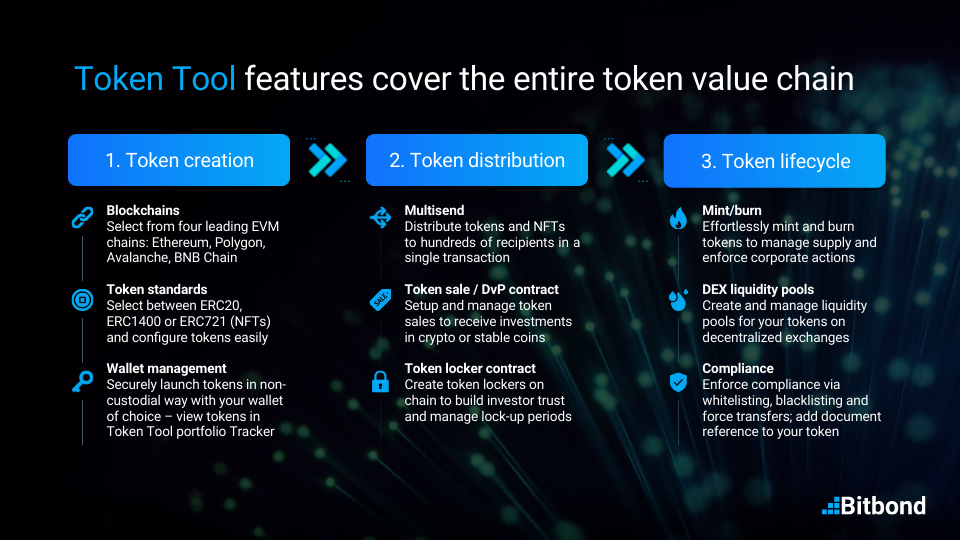

Tokenization platforms resembling Token Device by Bitbond, supply quite a lot of providers resembling creating, managing, and distributing tokens. Further options embody launching token gross sales, monitoring crypto portfolios and fuel costs. Token Device gives assist for 4 EVM appropriate chains together with Ethereum, Polygon, Avalanche and Binance Good Chain.

Portfolio Tracker

The Portfolio tracker perform offers customers an summary of the belongings they personal in addition to the full worth of their digital belongings. As buyers maintain funds in a number of custody options, it offers a seamless overview over their crypto-assets throughout totally different platforms. The worth is calculated by figuring out the consumer’s token stability and multiplying it by the present worth of the asset. To supply info on the kind of tokens the consumer owns, the portfolio tracker differentiates between ERC-20/ERC-1400 tokens and NFTs. To make token lifecycle administration extra handy, tokens might be managed straight from the tokenization platform.

Create Token

The Create token function permits minting tokens straight by means of utilizing the tokenization platform. It spares customers the should be proficient with good contract programming as no coding is required. The tokenization platform handles the technical know-how offering customers with a seamless course of for benefiting from tokenization. Asset tokenization is made rather more accessible by means of the usage of tokenization platforms. Earlier than the token is issued, customers should outline the token parameters like title, image, preliminary provide, and configure token options.

Handle Token

Tokens might be minted or burned utilizing the Handle token perform obtainable within the tokenization platform. Furthermore, this function permits the creation of liquidity swimming pools in addition to altering the token’s proprietor and renouncing possession. Utilizing this performance, customers may whitelist or blacklist pockets addresses after the token issuance. The handle token perform of Token Device works with all tokens, even people who weren’t created utilizing Bitbond’s tokenization platform.

Distribute token

The Distribute token perform permits customers to ship ERC-20 tokens to a number of recipients directly. In apply, the multisend function is often used when an issuer is required to ship a bundle of tokens or funds to a number of buyers on the identical time. It will also be used for curiosity payouts resembling dividend and coupon funds to buyers. The record of addresses can both be entered into the system manually or routinely by way of importing a CSV file. Lists of token holders might be downloaded as CSV information from block explorers like Etherscan.

Create token sale

Safety Token Choices (STO), Preliminary Dex Choices (IDO), or Preliminary Coin Providing (ICO) are token choices that may be created utilizing the Create token sale perform. In a token presale, aka a crowdsale, a predefined quantity of funds is distributed to buyers and issuers. With Token Device, it’s potential to configure the token presale in addition to outline the token providing’s worth, presale cap quantity and lock length.

Handle token sale

After a token sale is created, the Handle token sale perform permits customers to evaluate the parameters of the token sale straight by way of the tokenization platform. The parameters of the token providing might be edited till the beginning of the sale. Thus, further addresses might be added to whitelist buyers if whitelist is required, and a shareable token sale URL is supplied for accepting investments. The issuer may embed the token sale investor web page into their very own web site utilizing the tokenization platform’s iFrame function.

Create token locker

The Create token locker perform permits customers to disable tokens from being transferred for a selected time frame. For instance, Liquidity Pool or founder tokens of initiatives might be locked for a sure time frame to point out dedication to the challenge, and to additional enhance credibility,

Create NFT

The Create NFT perform is similar to the create token perform, nonetheless, a distinct token normal is used. In comparison with the create token function, the create NFT perform makes use of the ERC-721 token normal. Equally, no programming abilities are required because the good contract is generated routinely by the tokenization platform.

Handle NFT

To evaluate configurations and parameters of NFTs that had been already created, the Handle NFT function can be utilized. Moreover, this performance permits customers to connect metadata resembling photographs to NFTs or NFT collections. It is usually potential so as to add single information as metadata or to add a CSV file. Moreover, whitelist addresses might be modified. Much like the handle token perform, this function works for all NFTs even when they weren’t created utilizing Token Device’s tokenization platform.

Distribute NFT

NFTs might be despatched to a number of recipients on the identical time utilizing the Distribute NFT performance. Right here, Token Device helps the switch of ERC-721 in addition to ERC-1155 tokens. Likewise, the token addresses might be entered manually or routinely by way of a CSV add. This perform additionally works with all tokens even when they weren’t created with Token Device.

Create chain file

The Create chain file perform permits on-chain registry entries and the creation of on-chain messages. Thus, this function permits customers to maintain file of on-chain securities transactions. So as to add an on-chain message, both a traditional textual content or a hash can be utilized.

Fuel costs

The fuel worth refers back to the prices charged by the blockchain community per transaction. As these differ between chains, Token Device gives info on the fuel worth in USD and Gwei for Ethereum, Polygon, Avalanche and BNB Chain. For every community, costs are proven for gradual, regular and quick transaction occasions.

Blockchain know-how and tokenization are gaining in reputation because of the numerous advantages they create to monetary providers. Growing blockchain-based merchandise can show to be extremely difficult, particularly for organizations that aren’t specialised in it and lack the technical information to successfully develop such merchandise.

Tokenization platforms cater to that particular ache as they considerably improve entry to asset tokenization. Issuers seeking to profit from tokenization to fundraise their challenge, or handle belongings, can now simply leverage the ability of blockchain know-how by utilizing high notch asset tokenization merchandise. As tokenization platforms resembling Token Device are Web3 based mostly merchandise, no prolonged onboarding or cumbersome integrations are required. Merely connect with the tokenization platform along with your pockets and full the duties required.

The good contract safety and comfort that tokenization platforms supply is one other main step in direction of the mainstream adoption of blockchain know-how.