Whereas most mortgage debtors are managing to pay down their money owed, a small however rising minority are experiencing monetary stress as they grapple with the pressures of the turbulent financial system.

General, the Reserve Financial institution of Australia’s half yearly Monetary Stability Overview launched on Friday confirmed Australia’s monetary system remained sturdy sufficient to deal with the difficult financial situations equivalent to inflation and cost-of-living pressures.

Nevertheless, debtors with low incomes, massive loans, and low financial savings are nonetheless at increased threat of mortgage stress and arrears.

Resilience amongst mortgage holders

The place Australians as soon as had financial savings buoyed by the pandemic-era lockdowns and authorities stimulus, the overview indicated increased rates of interest and inflation had decreased the spare money move of most households.

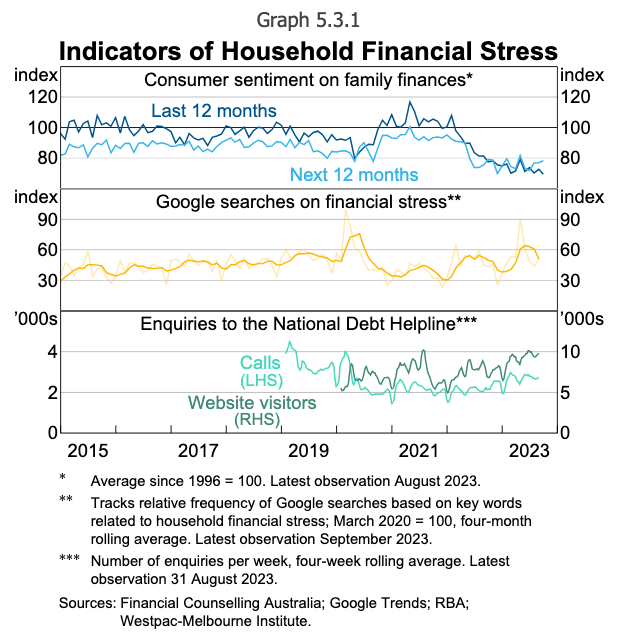

Many households had been adjusting their expenditure, as evidenced by slowing consumption progress and sentiment of their present or future monetary well being had declined sharply since early 2022.

Through the use of the baseline family expenditure measure (HEM), the RBA discovered that 5% of Australian owners can not cowl important bills, up from 1% final 12 months. These households are anticipated to have little capability to chop again on spending, the Monetary Stability Overview discovered.

Nevertheless, the quantity jumps when checked out extra broadly by way of a HEM measure that features gadgets which can be classed as discretionary spending however could be troublesome to regulate, equivalent to personal medical insurance and personal college charges.

By this measure, the share of variable-rate owner-occupiers whose bills and mortgage prices exceeded their revenue in July 2023 is estimated to be round 13%, up from round 3% in April 2022.

These debtors, nevertheless, are more likely to have some capability to scale back spending over time.

Mortgage stress current however not widespread

Whereas this can be regarding, these debtors aren’t essentially in mortgage stress but as they might be dipping into financial savings or refinancing their loans. There’s additionally little proof that Australians are turning to bank cards or private loans to cowl their bills.

Most debtors are additionally anticipated to be properly positioned within the occasion of an extra improve in rates of interest.

The direct impact of a hypothetical 50 foundation level improve within the money charge to 4.6% will increase the estimated share of variable-rate owner-occupier debtors who’re unable to cowl their bills (utilizing the baseline HEM) from round 5% to round 7%.

Of those debtors, about 30% are liable to depleting their buffers inside six months, which is equal to 2% of all variable-rate owner-occupier debtors.

But the indicators are clear that monetary stress has entered the collective minds of Australians, with the frequency of Google searches of phrases associated to family monetary stress elevated earlier this 12 months to its highest degree for the reason that begin of the COVID-19 pandemic in early 2020.

Monetary counselling providers such because the Nationwide Debt Helpline has seen a 28% improve within the variety of calls in comparison with final 12 months, which prompted ASIC to warn lenders about their monetary obligations in August.

That is additional corroborated by current analysis from debtors, which had seen a 60% rise in debt information year-on-year and monetary hardship circumstances bounce 25% over the quarter.

Insolvencies and mortgage arrears

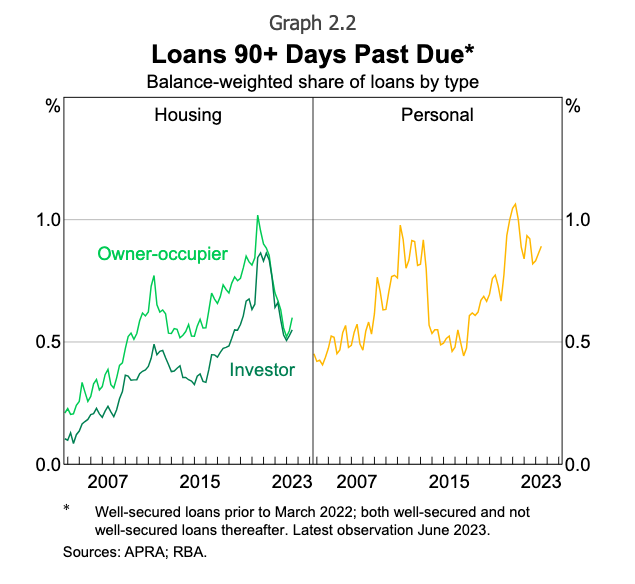

On the opposite finish of the mortgage stress spectrum, private insolvencies and arrears have remained low regardless of a current uptick. Hovering round 0.6% and 0.9% respectively, most households proceed to pay their money owed.

Lenders have reported that debtors have been extra resilient than anticipated of their means to service their debt, given the sharp rise in rates of interest. Whereas arrears charges are more likely to improve, they’re anticipated to stay very low.

About 1.5% of debtors are estimated to have their important bills and mortgage prices exceed their revenue and be at excessive threat of depleting any out there buffers.

Even when the unemployment charge had been to extend by 2% – round twice as sharply as projected within the by the RBA in August – the share of present debtors liable to working out of buffers over the following 12 months or so would probably stay at low single-digit ranges.

Equally, the RBA stated most debtors can be properly positioned to service their housing loans if rates of interest had been to extend additional.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter.