Therese Fitzgerald

Moving into the elevator in my workplace constructing, I used to be stunned to see an advert for Silicon Valley Financial institution. Then I remembered that, shortly after the San Jose-based financial institution was shuttered in March by the Federal Deposit Insurance coverage Corp., most of its property had been bought at a steep low cost by First Residents Financial institution. At present, it operates as a division of First Residents.

However regardless of the financial institution’s swift reincarnation, its collapse—together with the demises of Signature Financial institution in March and First Republic in Could—continues to reverberate all through the actual property capital markets, significantly for native and regional banks.

Originations by “small banks” fell 53 p.c year-over-year within the second quarter of 2023, in line with MSCI Mortgage Debt Intelligence, which nonetheless teams native and regional banks into one class, though the Federal Reserve immediately differentiates between “group” and regional banks.

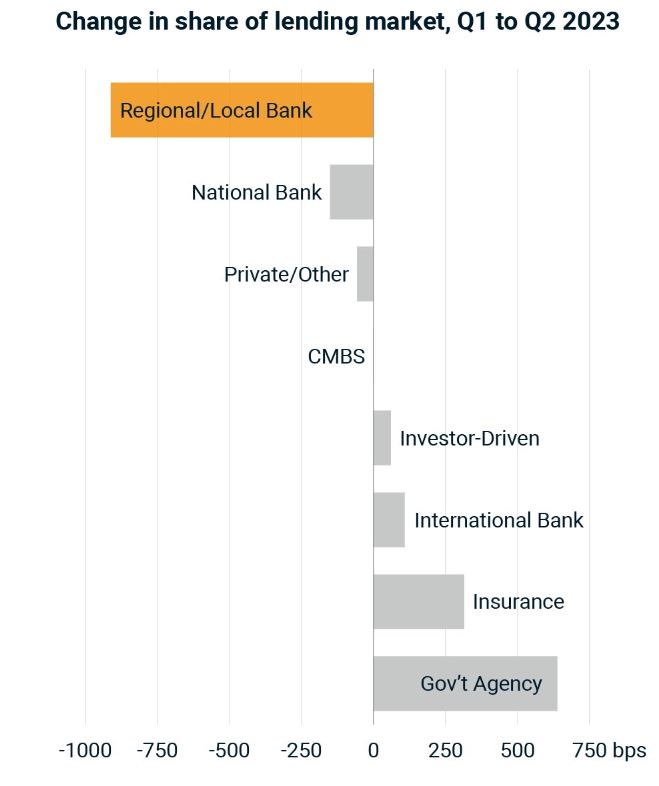

In the meantime, smaller banks’ share of economic actual property loans decreased from 34.2 p.c within the first quarter to simply 25.1 p.c within the second quarter. That’s essentially the most speedy decline in a single quarter ever, and one that’s significantly “troubling” for MSCI Chief Economist Jim Costello.

“The precise stage of their originations cooled between the primary quarter and the second quarter,” Costello remarked. “And that’s not one thing we’d have anticipated to see in any regular interval. In any regular interval, there’s extra deal exercise within the second quarter than within the first quarter.”

READ ALSO: How Are You Adjusting to the Re-Adjustment?

Between 2012 and 2022, MSCI finds, originations elevated 14 p.c on common throughout the second quarter because of seasonal patterns in deal making. This 12 months, second-quarter originations had been down 4 p.c. “It’s not like anyone else is simply pulling forward quicker than them,” stated Costello. “They’re really placing on the brakes.”

The explanation for the pullback, in fact, is multi-layered, in line with Costello. The financial institution failures, in fact, had a chilling impact on related establishments.

In 2009, amid the Nice Monetary Disaster, the Federal Reserve created a “nationwide financial institution” class to single out bigger establishments for Complete Capital Evaluation and Overview and regulation, and to separate them from smaller establishments that presumably wanted much less evaluation and fewer guidelines. When excessive rates of interest and the post-pandemic slide uncovered poor funding choices by some non-national banks this spring, nonetheless, there have been cries that the smaller establishments wanted extra scrutiny.

Financial institution failures apart, market situations are additionally growing banks’ value of capital and forcing them to redefine danger. “It could be tied to all of the underlying elements that led to troubles in these banks to start with,” Costello noticed.

And, don’t overlook, second-quarter deal quantity was down about 60 p.c from final 12 months when charges had been nonetheless pretty low.

The place it hurts essentially the most

The near-term impacts of small banks retreating are actually being felt by many non-institutional traders in markets comparable to Toledo and Kansas Metropolis that depend upon their relationships at smaller banks, Costello famous. There’s nonetheless debt accessible for these debtors, however will probably be costlier and extra “problematic.”

Supply: MSCI

“Within the quick time period, it limits the supply of debt to the standard purchasers of these regional and native banks,” he stated. “People who had been usually coming to them for financing had been smaller property homeowners and significantly in smaller markets.”

Although smaller banks aren’t simply in small markets. Signature Financial institution had $33 billion of New York Metropolis-area industrial actual property loans on its books on the finish of 2022—and $20 billion of that was multifamily.

Costello doesn’t, nonetheless, foresee banks backing away from industrial actual property in any everlasting manner. For a lot of, serving to native communities develop is “explicitly” of their charters. However smaller banks are more likely to proceed extra conservatively whereas debt and fairness markets reprice.

“In case you take a look at the senior mortgage officer survey from the Fed, clearly, financial institution lenders have gotten a bit bit extra cautious and restrictive of what they’re prepared to do,” Costello stated.

And whereas smaller banks will seemingly be exempt from the brand new capital necessities for big lenders being debated by Congress, the tighter requirements are anticipated to have an effect on the conduct of all banks.

“They’re simply pulling again due to adjustments within the monetary markets, which might be a brief factor,” he stated. “However long-term, they’re in all probability going to nonetheless need to be in the actual property world. That’s their bread and butter.”

So, whereas Silicon Valley Financial institution will in all probability at all times remind us of the worst-case state of affairs, its re-emergence might also be emblematic of the enduring demand for smaller lending establishments.