If you’re interested by altering your automobile you could have heard the time period ‘detrimental fairness.’ On this article, we assist clarify what this implies and the way it may affect your subsequent automobile buy.

What does detrimental fairness imply?

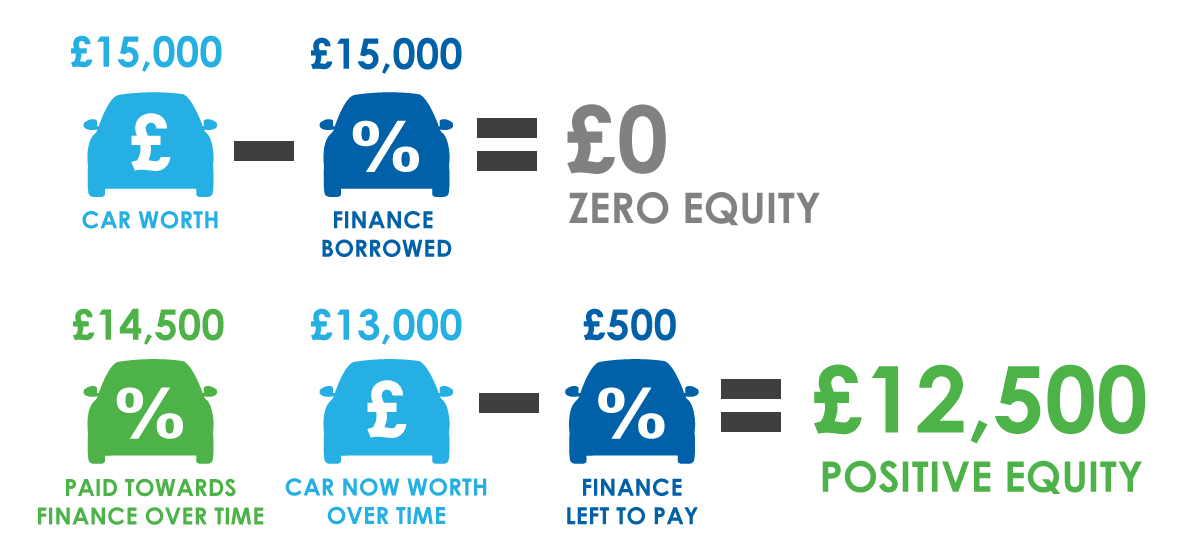

A automobile that’s in detrimental fairness means it’s value lower than the excellent finance in opposition to it. That is usually brought on by the worth of the car depreciation.

For instance, when you purchased a automobile for £15,000, with finance for £15,000 and the car is now value £13,000, and you’ve got solely paid off £1,500 you’d be in detrimental fairness as there can be £500 distinction between the worth of the automobile and the excellent finance.

Nonetheless, when you had purchased a automobile for £15,000 with preliminary finance for £15,000 and the automobile is now valued at 13,000 however you have got paid off £14,500 you wouldn’t be in detrimental fairness as you might be close to the top of your settlement and have little or no finance excellent.

Unfavourable fairness can generally be known as the other way up, unsuitable method up or again to entrance.

Why does detrimental fairness happen?

Unfavourable fairness can generally happen in case you are seeking to exit a automobile finance settlement sooner than anticipated.

Most vehicles will depreciate in worth and are prone to depreciate quicker in the beginning of a monetary settlement, particularly on newer (or almost new vehicles). You might be much less prone to be in detrimental fairness later in your monetary settlement because the repayments and protecting the depreciation.

When you attain the top of the settlement there can be no remaining finance stability so no detrimental fairness. The longer you keep in your settlement the much less doubtless it’s to have detrimental fairness.

Unfavourable fairness and PCP automobile finance

Unfavourable fairness will be extra prone to happen relying on the kind of automobile finance that you’ve got.

If you’re paying in your automobile by means of a PCP deal, then detrimental fairness will be extra frequent. It’s because you might be typically paying smaller, month-to-month funds leaving a balloon cost on the finish of your settlement. The quantity you owe exceeds the worth of the automobile.

Unfavourable fairness and Rent Buy automobile finance

When you’ve opted for a rent buy automobile finance settlement, which doesn’t have a balloon cost, then you might be opting to pay for your entire automobile (and personal it on the finish of your settlement). This implies you might be paying off the worth of the automobile a lot faster than PCP and are subsequently much less doubtless for the automobile to be in detrimental fairness do you have to want to exit your settlement.

How do I do know if my automobile finance is in detrimental fairness?

You’ll need to get a settlement out of your present automobile finance supplier.

It’s best to get an estimate of your car’s present worth too. This may be executed by visiting your native used automobile dealership or there are instruments on-line that may present estimates. These embody:

You need to be truthful concerning the mileage and situation of your automobile so you will get essentially the most correct valuation.

If we’re your present supplier, then you’ll be able to login to your My Go Automotive account and get a settlement determine.

What ought to I do if I’ve detrimental fairness?

To clear the detrimental fairness, you must both:

1) Put financial savings in direction of the distinction or2) Keep in your present finance settlement and proceed to make extra funds till the excellent stability falls beneath the car’s worth.

How do I get automobile finance when I’ve detrimental fairness?

Right here at Go Automotive Credit score, we’re unable to take any detrimental fairness and add it on to a brand new finance settlement. It’s unlikely different automobile finance suppliers would do that both.

If there may be detrimental fairness, then you’ll both must make up the distinction your self to clear the finance or proceed to make extra funds in your finance settlement till you might be now not in detrimental fairness.

Need to apply for automobile finance?

Our automobile finance specialists are all the time readily available to elucidate how we may enable you along with your subsequent automobile buy. If you’re an present buyer seeking to improve or a brand new buyer to Go Automotive Credit score communicate to us in the present day to know your choices.