The American healthcare funds system is plagued with billing errors, fraud, and confusion. The typical price of it’s estimated at round $325 billion per yr.

Whereas some medical payments are right, the chances aren’t in sufferers’ favor. Round 80% of medical payments have errors, 1 / 4 of that are as a consequence of typos. These errors, whereas seemingly tiny, may cause sufferers to pay 1000’s of {dollars} unnecessarily out of pocket, sparking a domino impact of life-changing proportions.

“You’ve gotten most individuals dwelling paycheck to paycheck. So the concept abruptly any person has to spend $500 – $2,000 out of pocket, that results in homelessness, that results in individuals not with the ability to feed their youngsters,” mentioned Jonathan Anastasia, Government Vice President, Crypto & Safety Innovation at Mastercard.

Whether or not or not it’s by way of error or fraud, healthcare billing is an space rife with problems, and sufferers are paying the worth.

In a latest partnership, Mastercard joined forces with HealthLock, to convey readability to sufferers’ medical payments.

Fraud Thrives inside Chaos

David Burzynski, CMO, and Chief Buyer Officer at HealthLock, defined that many pointless funds are made as a result of complexity of the system. Sufferers are unaware of the varieties of errors that may exist and the way they are often rectified, leaving them with no different choice than to pay.

“Fifty-Six % of Individuals are confused by medical insurance and medical billing,” he mentioned.

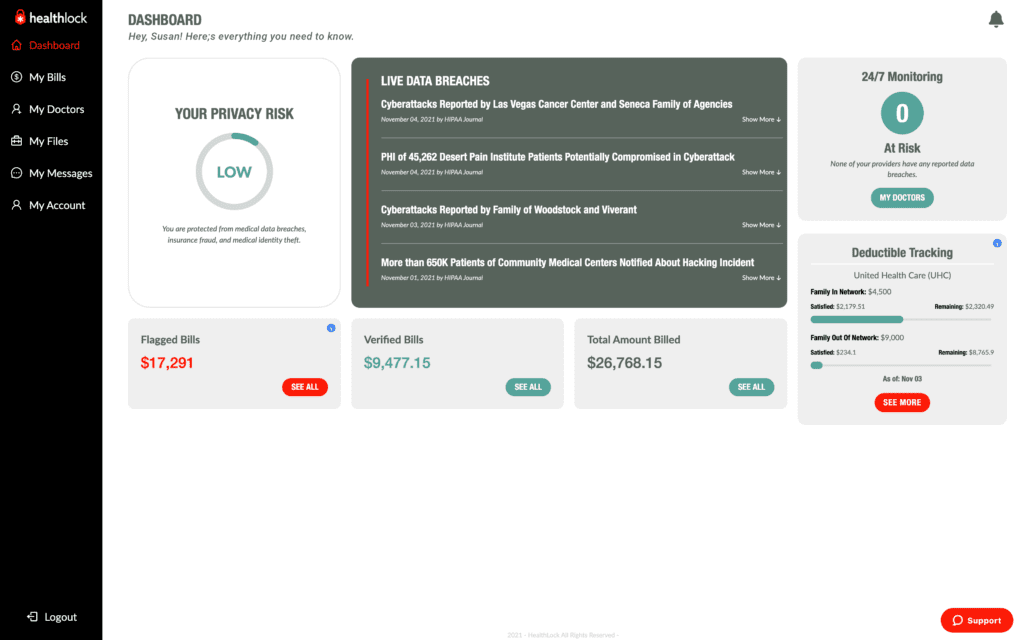

HealthLock, an organization offering sufferers with a service that helps preserve management of their healthcare funds, has seen these points and deployed machine studying and trade experience to permit their clients to maintain monitor of payouts related to their identify.

“Our product focuses on privateness, management, and financial savings,” mentioned Burzynski. “As individuals are going to the physician and receiving these payments, we need to shield them from information breaches, confusion, and overbilling.”

Based mostly on a dashboard itemizing all healthcare claims related to their identification, Healthlock flags the claims they consider may very well be faulty, offering their clients with choices that would save them cash. As soon as the affected person is synced with the community, the corporate routinely vets their claims.

“That steady monitoring piece can’t be understated,” mentioned Anastasia, explaining that one of these automation had allowed Mastercard to detect and cease fraud in different sectors they’d entered.

Representatives of HealthLock informed of situations the place payouts have been diminished by 1000’s just because they’d been marked as an elective process as an alternative of an emergency. They defined that in lots of instances, out-of-pocket payouts occur as a consequence of a lack of awareness in regards to the system and the totally different outcomes codes and language could suggest.

As well as, Burzynski defined, fraud was rampant within the healthcare funds system. The sophisticated nature of healthcare billing may cause discrepancies in declare submitting, leaving a degree of weak point that fraudsters can exploit. Breaches of well being information by fraudsters and subsequent malicious exercise have risen to greater than 59 million instances final yr, up from 40 million in 2020.

Fraud provides one other layer to the extent of faulty funds, utilizing the system’s chaos to fly beneath the radar. Burzynski mentioned that as a result of transparency afforded by the HealthLock dashboard, fraudulent claims may be made clear.

“In a single case, we had a buyer who’s identification had been used to say for 3 therapies undertaken on the identical day in three totally different states,” mentioned Burzynski. He defined that these claims historically would have been permitted as a result of variety of totally different healthcare suppliers, insurance coverage suppliers, and sufferers’ lack of awareness of their payments.

“Increasing belief”

Whereas HealthLock had developed its answer earlier than Mastercard bought concerned, the partnership has allowed them to broaden their attain.

Burzynski defined that the partnership will initially open HealthLock’s companies to tens of millions of US-issued HSA and FSA Mastercard playing cards, with plans to broaden to different packages later within the yr.

For Mastercard, the partnership is an “extension of belief” that has reached past its conventional positioning as a monetary companies model.

“If you wish to have interaction in an ecosystem, you need to know that every one these various things are coated within the background,” mentioned Anastasia. “So for ourselves, the extension of this concept that we’re not only a bank card firm, we’re a expertise firm that gives all these options to assist construct belief within the ecosystem.”

The corporate’s expertise in different sectors had allowed them to broaden that information to fulfill the wants of different sectors. By means of their partnership with HealthLock, Mastercard was approaching the healthcare system’s fee downfall.

“All of the issues which are happening within the healthcare trade, we see the identical form of fraud that we’ve been stopping on his hardcore funds aspect as effectively. With our options using AI and expertise, we’ve been in a position to assist shield 125 billion transactions final yr. Our security internet product has stopped $35 billion of fraud assaults over the previous few years.”

“The extension of that’s the shoppers concerned in transactions in relation to medical billing, in relation to fraud, in relation to information breaches. That is the correct extension into that space to assist set up additional belief of the patron.”

RELATED : FIs Face Obstacles to Fraud Preventing AI Adoption

.png#keepProtocol)