Kensington Mortgages has accomplished a £548m residential mortgage-backed securities transaction.

The securitised loans had been chosen to incorporate solely owner-occupied, excessive LTV loans lately originated by the specialist mortgage lender.

Kensington has been an lively RMBS issuer within the UK market nevertheless it has been absent from the general public securitisation markets for 2 years.

In March, it was bought by Barclays Financial institution UK PLC. As a part of the acquisition, Kensington continues day-to-day enterprise operations as normal, supporting a broad vary of debtors that the Excessive St would sometimes not serve.

The securities transaction, which was accomplished yesterday (1 December), is the primary public deal underneath Barclays possession.

This commerce has been designed by Kensington to de-risk a portfolio of mortgages from Barclays’ stability sheet somewhat than to lift funding for the enterprise.

Kensington began the advertising and marketing of this bond in early November, privately putting the residual consideration and the unrated bonds to 3rd occasion traders.

It publicly introduced the deal final Friday to the markets in an effort to obtain a extra broadly syndicated course of for the remaining mezzanine notes. Barclays is retaining the senior notes of this securitisation.

The lender stated the reception from the markets was robust from the start of the method throughout all supplied tranches. It resulted in excessive protection ranges for the Class B to E notes, being respectively 5.1x, 6.8x, 5.0x and a pair of.9x oversubscribed at IPTs.

Protection reached on common 4.3x at remaining phrases, and pricing tightened on common by 40bps from IPTs to land at DMs of +160bps, +245bps, +350bps and +535bps respectively for sophistication B, C, D and E notes.

The ultimate ranges throughout mezzanine notes ended up inside all latest UK RMBS mezzanine notes positioned by UK issuers this 12 months. Kensington additionally loved a really numerous orderbook with 10 distinctive traders allotted for a complete of £70m notes supplied.

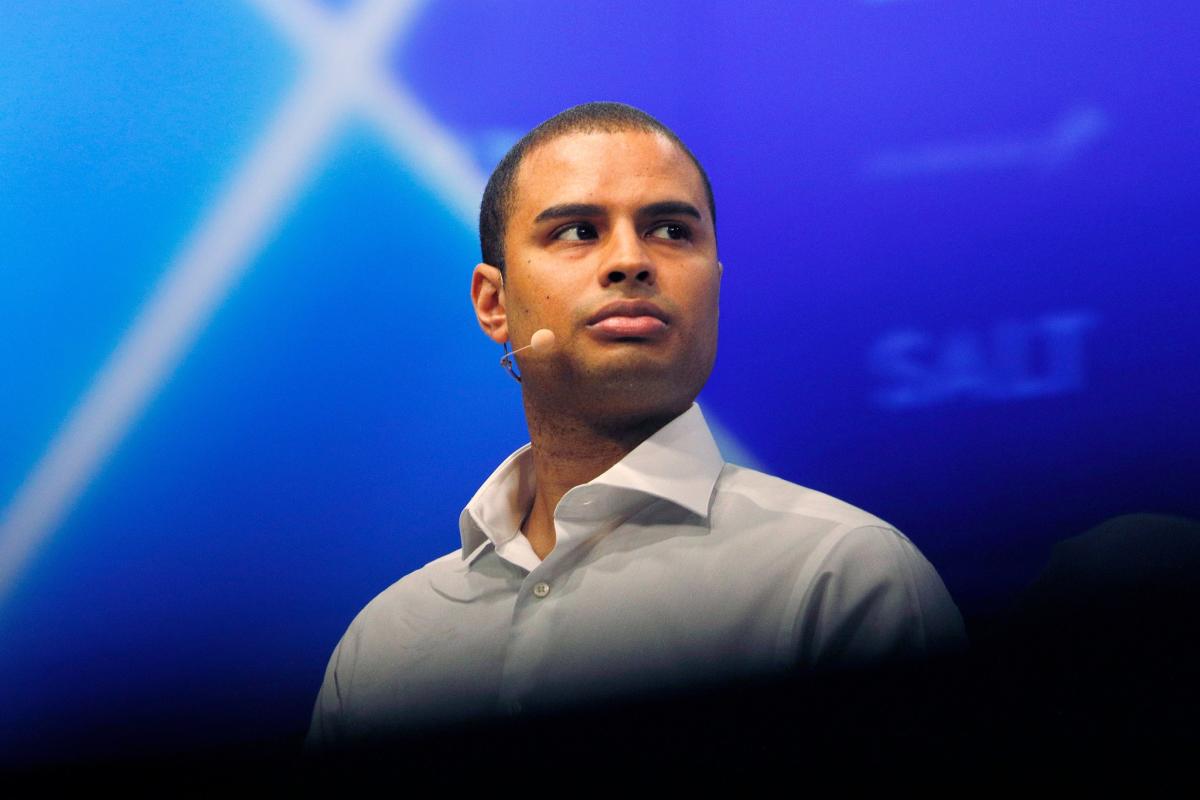

Kensington Mortgages capital markets & digital director Alex Maddox stated: “This deal is a profitable first public commerce for Kensington underneath Barclays’ possession; we have now managed to draw vital and granular orderbooks, with depth and number of the traders concerned.

“This demonstrates a continued degree of confidence from traders within the Kensington platform. The robust place we have now constructed over time within the UK RMBS market has helped us print a superb transaction, pushing spreads throughout mezzanine notes to their tightest ranges since April 2022.”