A variety of pupil mortgage debtors have reached out to NCLC in the previous couple of months relating to points with Public Service Mortgage Forgiveness (“PSLF”) and the one-time cost depend adjustment. Debtors are reporting issues with how MOHELA is counting their eligible funds after consolidating their loans, together with that their accounts are incorrectly displaying zero qualifying funds for PSLF.

If in case you have not too long ago consolidated your loans and submitted your Employment Certification Type in an effort to be eligible for credit score towards PSLF, don’t panic in case your cost counts aren’t up to date accurately but. The PSLF credit score counts are solely briefly reset to zero after debtors consolidate and shall be corrected within the coming months.

Beneath the present cost depend adjustment, debtors will get PSLF credit score for previous time working in public service whereas in compensation earlier than consolidating. The account adjustment helps hundreds of thousands of debtors get nearer to mortgage forgiveness, however the course of continues to be ongoing. Many debtors won’t see correct changes to their accounts till later in 2024.

For the most recent updates on the cost depend adjustment, together with a timeline of when the evaluation shall be accomplished, go to the Division of Training’s web site at: https://studentaid.gov/announcements-events/idr-account-adjustment.

MOHELA is warning debtors of the issue

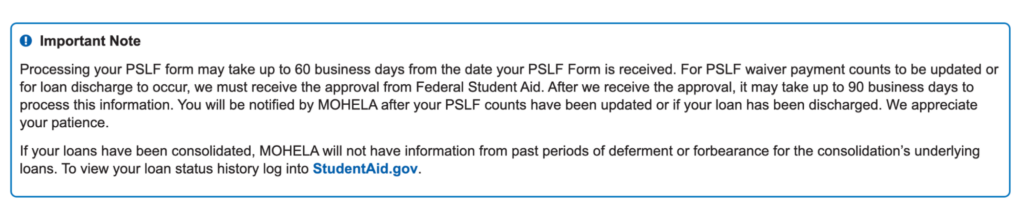

MOHELA, the mortgage servicer for the PSLF program, has acknowledged that cost counts for PSLF could briefly present zero qualifying funds. This may be actually complicated for debtors who have been informed they wanted to consolidate their loans in an effort to be eligible for PSLF or to maximise their eligibility for PSLF.

MOHELA not too long ago added the next warning messages on debtors’ PSLF cost depend tracker:

What does this imply for you?

Should you not too long ago consolidated your loans to make the most of the one-time cost depend adjustment, it might take some time to your account to be up to date to replicate your qualifying funds for PSLF. Don’t panic but when you’ve got obtained a message saying you’ve zero qualifying funds. Should you suppose you ought to be eligible to have your loans forgiven now below PSLF however are being denied, or in case you are having different points with loans, file a grievance with the FSA Ombudsman.

Do not forget that consolidating ineligible loans is just one step to getting credit score for PSLF. You additionally need to submit your PSLF Employment Certification Type for every public service job you held whereas in compensation (together with for time throughout the cost pause), along with making qualifying funds every month. Use the guidelines under to be sure to’re on monitor for PSLF. And when you’ve got points, tell us!

Be sure you’re on monitor for PSLF

Use the PSLF Assist Device to be sure to are in a qualifying compensation plan, have qualifying employment, and have qualifying loans for PSLF.

Think about consolidating your loans earlier than April 30, 2024 to take full benefit of the one-time cost depend adjustment. This may imply consolidating loans that might in any other case be ineligible for PSLF—resembling FFEL, HEAL, and Perkins Loans—into a brand new Direct Consolidation Mortgage. It may also imply consolidating your Direct Loans collectively to maximise the credit score you may get towards PSLF, resembling if you happen to took out separate loans for undergraduate and graduate packages which have completely different compensation histories. See our web page on the one-time cost depend adjustment for extra data.

Submit your PSLF Employment Certification Type (ECF) utilizing the PSLF Assist Device to fill it out and ship it to your employer to signal. You will have to submit a separate ECF for every public service job you’ve labored whereas in pupil mortgage compensation in an effort to get credit score for that point towards PSLF. You’ll want to embody ECFs for qualifying jobs labored throughout the cost pause.

Overview your account with MOHELA, the mortgage servicer for PSLF. If MOHELA just isn’t your mortgage servicer for your entire federal pupil loans, then you definately possible have a mortgage that’s not presently eligible and must consolidate to turn out to be eligible, or you haven’t submitted your first PSLF type but.

File a grievance with the FSA Ombudsman in case you are nonetheless having points. You also needs to file a grievance if you happen to suppose you ought to be eligible for PSLF now however have denied or haven’t heard something about your software.

Contact a lawyer in case you are nonetheless having issues with PSLF.

Share your story with NCLC to assist us make PSLF work for debtors!