Issues don’t at all times go based on plan for many enterprise entrepreneurs. Typically, when every part appears to be going based on plan, a tidal wave of unpredictability hits you.

Tools malfunction could have necessitated a restore or alternative. Or one among your most essential purchasers could also be overdue on an bill. It’s additionally potential that your money stream takes a success as a result of enterprise is slower than regular.

That is the place your emergency fund comes into play. In case your agency is at risk of sinking on account of unanticipated prices, you’ll be able to lean on it for help.

To make it via powerful financial occasions or to broaden the agency, firms usually face a significant problem: an insufficient provide of money.

Many small firm house owners nonetheless face monetary difficulties, with 38% failing because of poor money stream.

When occasions are powerful, a small enterprise that doesn’t have sufficient money readily available could also be pressured to close its doorways for good.

What Is a Enterprise Emergency Fund?

Do you keep in mind placing away some cash in case of an sudden private expense? That concept is simply as relevant to a enterprise.

Your organization’s emergency fund is its money reserves. It’s funds that you just’ve put away for emergencies, and it’s obtainable to you everytime you want it.

The expression “emergency fund” conjures photos of a financial savings account or a field beneath your mattress stuffed with payments, nevertheless it doesn’t must be made up totally of money.

Your reserves may embrace short-term, liquid property reminiscent of cash market funds that may be swiftly transformed to money.

Whether or not you present a web-based phone service or run a small comfort retailer, companies of all sizes ought to have an emergency fund in place. Such funds can preserve the corporate afloat throughout attempting occasions by:

Providing you with a monetary buffer to cowl prices within the occasion of recessions or market downturns

Avoiding debt if you could pay sudden or unavoidable payments

Guaranteeing you don’t eat into financial savings amidst money stream struggles

Defending the enterprise’ credit standing and enterprise proprietor’s private monetary standing

What Are the Benefits of Having a Enterprise Emergency Fund?

Our desires for the long run could not at all times go based on plan, regardless of how arduous we attempt. Within the occasion of an emergency or pure calamity, there isn’t a technique to foresee what would occur. Even so, you’ll be able to put together for it.

Some great benefits of having an emergency fund communicate to its significance. Listed here are a number of the advantages to stay up for:

Monetary safety

Having an emergency fund readily available will allow you to sleep higher at evening and focus on your day-to-day duties, like evaluating DocuSign vs Adobe. Take into account that crises can take many kinds, starting from sudden illness to fireplace outbreaks or a pandemic.

These examples and every other catastrophe will want completely different responses, however the truth that you could have an emergency fund to fall again on will stay fixed. Bear in mind this when making ready to your subsequent emergency.

Wet day spending

Even amid a disaster, life continues. Because of this, you’ll must proceed paying for requirements like meals, lease or mortgage, and utility payments like electrical energy and fuel, in addition to web entry.

You’ll nonetheless must preserve your skilled group membership present, too. You possibly can accomplish all of this and nonetheless run your small business if in case you have an emergency fund as a part of your IT enterprise continuity plan.

Keep away from dipping into financial savings

Small firm house owners could must dip into their very own pockets in occasions of disaster to maintain their firms afloat. Having an emergency fund may allow you to keep away from emptying your private financial savings accounts.

Having an emergency reserve helps you stop late funds to staff, amongst different bills.

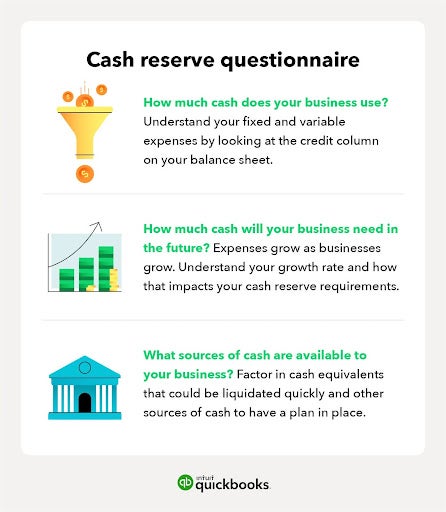

Tips on how to Estimate Your Emergency Fund Dimension

The sum of money it’s best to keep in reserve relies upon closely on the opposite components that affect your group, in addition to your operational bills.

Think about the next when evaluating how a lot cash to save lots of in case of an emergency:

Stock and receivables

Companies with slow-moving receivables or inventories ought to keep a bigger account for emergency funds.

The fund will present cowl for operation prices and different bills in circumstances of late buyer fee or money being tied up in slow-moving inventories.

Utilizing platforms that enable prospects so as to add free e-signatures to paperwork can act as an extra buffer. By giving distributors a fast and straightforward technique to signal contracts and invoices from anyplace, you’ll be able to velocity up the fee course of and cut back the possibilities of needing to dip into your emergency fund.

Your private standing

Is it potential so that you can go with out a paycheck for a time frame? Is your small business a full-time job or a facet exercise? It’s possible you’ll not require as a lot cash in reserve if it’s the latter.

Seasonality

If your small business practices rely closely on cyclical or seasonal income, you might need to contemplate growing your emergency reserve. The extra risky the agency, the extra emergency funds it ought to maintain.

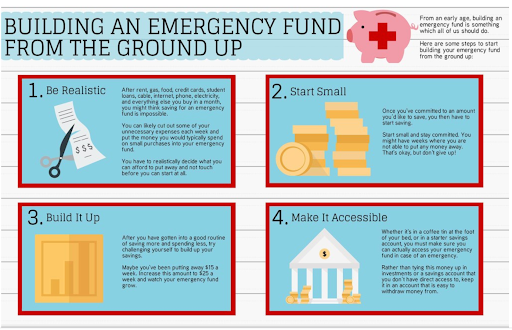

Constructing an Emergency Fund for Your Enterprise

Probably the most tough a part of placing collectively a enterprise emergency fund is deciding the place the cash will come from. In case you’re a lone entrepreneur or a small agency with a slim revenue margin, this may be very difficult.

No matter your state of affairs, you’ll be able to practically at all times discover a methodology to save cash and add it to your emergency fund. It’s possible you’ll by no means have to faucet into your small business’s emergency fund, which is the best-case state of affairs.

Listed here are just a few suggestions to information your emergency fund creation technique.

Calculate the quantity required

How a lot working capital would you could preserve your organization working if it couldn’t function for a month?

No matter your response, it’s best to save for that eventuality now. Preserve saving even for those who hit your financial savings goal in a brief interval. Don’t rely in your funds at all times being enough within the occasion of an emergency or catastrophe as a result of they’re unpredictable.

Maximize your financial savings

The identical credit score union or financial institution the place you at present have a enterprise account can be utilized to arrange a separate one to your emergency fund.

As your funds improve, it’s best to contemplate inserting a part of it in a cash market account. Or attempt one other account that provides the next price of return than a typical financial savings account.

Nevertheless, ensure you come up with the money for in your common account so to entry it shortly within the occasion of an emergency.

Schedule your funds

Preserve a daily deposit schedule and stick with it. Determine on a deposit plan that works for your small business, whether or not weekly, biweekly, or month-to-month.

Don’t be afraid to begin small

In case you can solely spare a small quantity a month to start, put it aside. Although there’s by no means an ideal second to begin a financial savings account for sudden bills, even a small sum may add up. You possibly can increase that quantity if gross sales decide up or you could have more money mendacity round.

Begin by taking a look at your small business processes and expenditures and see if there are methods to save cash. Go searching for one more supplier if prices for providers reminiscent of domains preserve rising and swap to a fundamental web service.

As a enterprise, it’s pure to need to put money into the perfect digital signature software program, payroll platforms, automated instruments, and communication options. Whereas these can save your small business cash within the long-run, it’s essential to think about whether or not you’re paying for pointless options. It’s possible you’ll simply be capable of swap plans and even use free software program that also will get the job accomplished.

In case you lease your small business premises, you might also need to discover a cheaper facility or attempt distant working. Profiting from these cost-cutting methods can quickly lead to financial savings which you can stash away for later

Deposit a part of your income

By setting apart a specific amount of your month-to-month earnings, you’ll be able to simply hyperlink your financial savings to income. Your financial savings will rise in keeping with income and fall in tandem with a decline in income.

Seasonal firms can profit from this, as it’s regular for revenue to rise or fall at a particular time of 12 months.

When Ought to You Use Your Emergency Fund?

There are all kinds of sudden conditions that require rapid consideration. A well-managed money stream forecast instance can help you in figuring out the suitable time to make use of your rainy-day reserve.

Some occurrences that will sign that you could use your emergency fund embrace:

Pure disasters — This is a superb time to make use of your emergency fund. It might be circumstances reminiscent of a flood, fireplace, hurricane, twister, or different weather-related occasions.

Financial hunch — An financial recession or decline in curiosity in your merchandise or trade.

Shedding a key worker — Lack of a helpful employees member that may negatively have an effect on gross sales or demand a substantial funding of time and assets to switch.

Sicknesses — Illness or different private challenges that stop the enterprise proprietor or a key worker from doing their job.

Lawsuits — These are uncommon however not remarkable occurrences introduced on by a number of conditions like office accidents.

Shedding a key buyer — Lack of a customer-friendly tradition can result in the departure of a key shopper who’s answerable for a big chunk of your organization’s income. Creating a powerful, constant model utilizing your e mail model information can assist stop this.

Particular circumstances — In case your revenue isn’t sufficient to cowl bills and you might be unable to make up the shortfall.

Shield Your Future With an Emergency Fund

A enterprise’s emergency fund serves the identical objective as a private emergency fund. Having a reserve of money could make the distinction between just a few months of arduous occasions and the tip of your agency. For individuals who depend on their enterprise as their sole supply of revenue, having an emergency fund is as important as an enterprise safety system.

It’s unbelievable if you have already got a enterprise emergency fund. However for those who haven’t already, now’s the perfect time to get began.

Searching for entry to enterprise funding? Nationwide Enterprise Capital’s award-winning crew can assist you discover essentially the most sum of money you qualify for, then help in reviewing your lending choices. You possibly can give attention to working your small business, whereas our crew does the heavy lifting. Apply now to get began!