Asset tokenization has emerged as a focus of innovation within the monetary providers panorama. Monetary establishments’ recognition in direction of the advantages of tokenizing belongings is witnessing vital development. Consequently, there’s a rising want for tailor-made options that align with institutional necessities. Bitbond is partnering with Ledger to meet these particular wants, enabling organizations to facilitate safe & scalable entry to institutional-grade asset tokenization merchandise.

Understanding the Rising Significance of Asset Tokenization for Institutional Gamers

Asset tokenization describes the illustration of possession of real-world belongings or monetary merchandise into digital tokens that run on blockchains. This innovation is gaining traction for varied causes.

Firstly, it enhances transparency and reduces operational prices by automating many points of main markets in addition to asset lifecycle occasions.

Secondly, it unlocks higher liquidity for historically illiquid belongings by means of fractional possession. This offers establishments with higher means to diversify their portfolios, in addition to lowering the barrier to entry for buyers, enabling entry to a broader set of buyers. Which affords elevated accessibility and effectivity of buying and selling belongings on the secondary market globally.

Lastly, there it considerably reduces threat associated to Ship vs Cost (DvP) by offering notable effectivity features in fee settlement. World on the spot settlement is achieved because of the peer-to-peer nature of blockchain permitting events to commerce tokenized belongings throughout networks with out counting on a centralized middleman to facilitate the transaction. This idea is also referred to as atomic swaps.

Whereas the benefits of asset tokenization are clear, establishments face hurdles on the subject of adopting such progressive applied sciences. Blockchain-based options have confirmed to be too advanced and troublesome to implement. Let’s not neglect the dearth of essential safety features, in addition to their lack of scalability. This led to cumbersome, pricey, and prolonged processes upon integrating inside present techniques.

The excellent news is that Bitbond’s partnership with Ledger and its Ledger Enterprise platform brings an finish to those challenges. Enabling gamers with seamless entry to the world of Web3, DeFi, and blockchain expertise.

Bitbond joins forces with Ledger to deal with institutional wants

It is a landmark collaboration as Bitbond joins forces with a extremely revered identify within the blockchain and digital asset custody panorama: Ledger. Collectively, we now have launched a groundbreaking resolution revolutionizing the best way establishments situation and handle digital belongings.

On the core of this partnership lies the combination of Bitbond Token Instrument into the Ledger Enterprise Platform. This integration affords customers with a centralized hub for issuing and managing a various vary of blockchain-based belongings and functionalities.

Token Instrument serves as a Web3 sensible contract generator that was launched by BItbond in early 2022. It’s particularly designed to streamline the method of making and deploying sensible contracts by enabling customers to configure on-chain options effortlessly. Utilizing its intuitive interface, anybody can profit from Token Instrument’s audited sensible contract templates to configure their tokens accordingly.

As we prioritize ease-of-use and user-friendliness, the purpose is to make asset tokenization accessible to anybody, wherever, no matter their technical information. Thereby we make sure that even non-technical customers can successfully leverage asset tokenization and blockchain expertise.

Token Instrument sensible contracts cowl a large set of use instances reminiscent of ERC20 and ERC1400 tokens, NFTs and NFT drops, token gross sales, token lockers, fee streams, and extra. Token Instrument helps Ethereum and eight+ main EVM-chains. Token Instrument is now formally built-in into the Ledger net utility, permitting Ledger prospects to create and deploy sensible contracts from a well-established supply.

What’s Ledger Enterprise?

Ledger has established itself as a frontrunner in blockchain safety and infrastructure. The corporate is famend for its dedication to offering each customers and establishments with sturdy options for safe digital asset administration and custody. Ledger Enterprise is the enterprise product line of properly famend IT safety agency Ledger, most identified for his or her {hardware} wallets adopted by tens of millions of retail customers. Ledger’s monitor document consists of:

6M gadgets bought to customers throughout 200 nations

Onboarded 100+ monetary establishments and types as purchasers

20% of the world’s crypto belongings secured utilizing their expertise

What’s Ledger Vault?

Ledger Enterprise Platform is a safe SaaS digital asset administration resolution, permitting companies to self-custody and handle their digital belongings operations at scale. It offers Custody, Staking, Tokenization, DeFi, Buying and selling and NFT / Web3 integrations, with superior automation, governance and reporting capabilities.

The cornerstone of this partnership is the seamless integration of Bitbond Token Instrument into Ledger Enterprise Platform, providing an all-in-one resolution for establishments searching for to streamline their asset tokenization processes.

This integration allows establishments to tokenize their belongings with ease whereas having fun with the safety and comfort of the Ledger Enterprise atmosphere. In consequence, asset tokenization turns into an easy and hassle-free course of for institutional customers.

Simplified Consumer Expertise

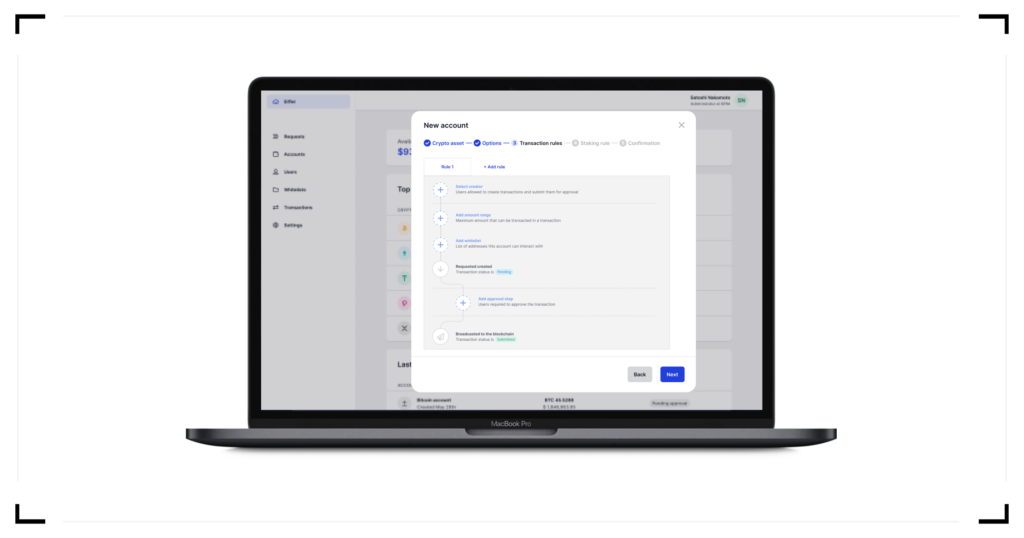

The combination brings forth a simplified consumer expertise, characterised by two key options:

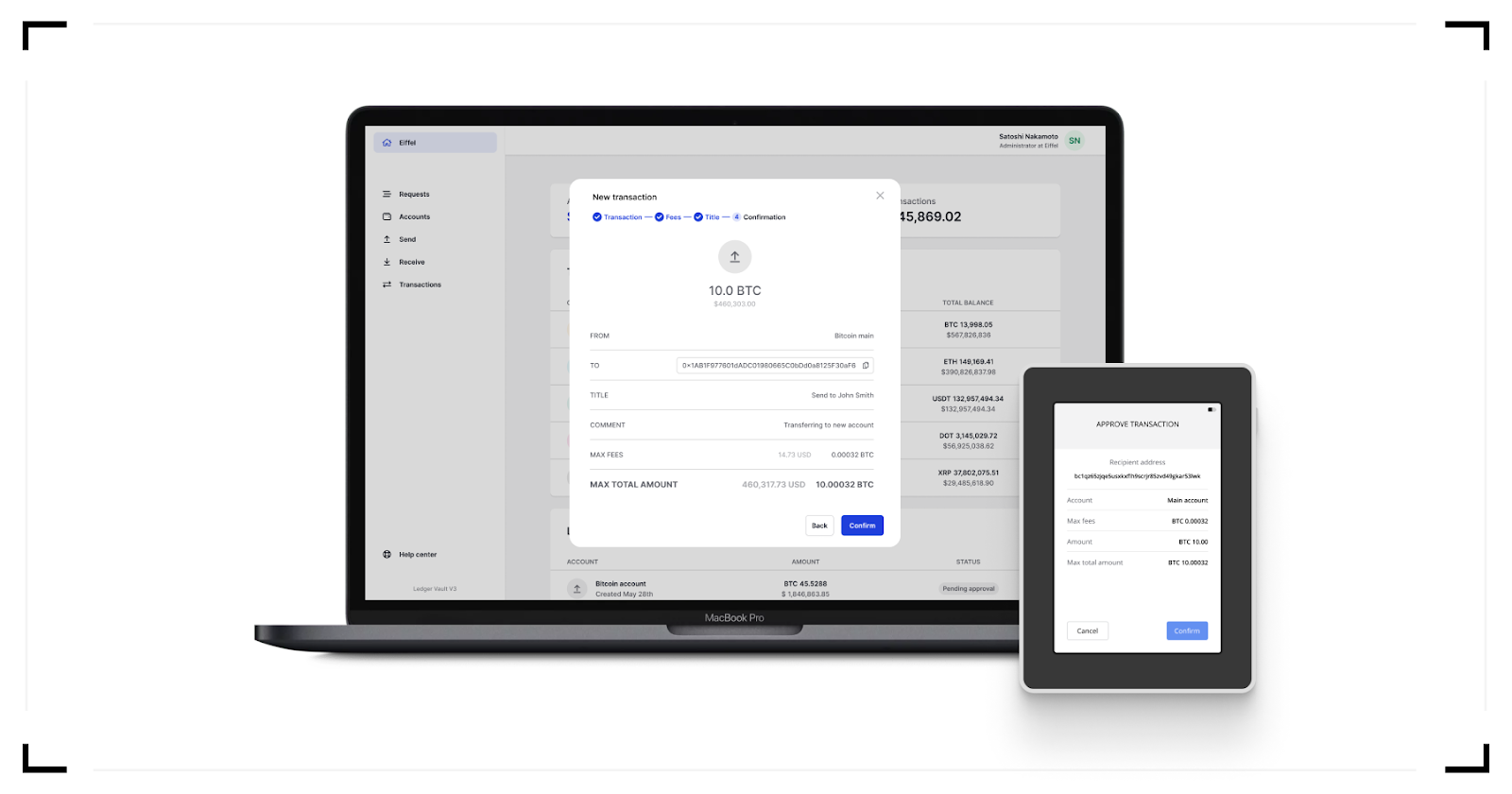

Clear signal function: What you see is what you signal

Normally, when approving a transaction in your pockets, most suppliers don’t show the precise configuration of the sensible contract that’s being deployed. The trusted show of Ledger’s resolution permits all approvers to see precisely what they’re signing, offering the transparency required in bank-grade governance and safety. Reasonably than exhibiting incomprehensible bytecode, info is displayed in a simple to learn and to know method.

API Entry: Create and handle token contracts at scale

Token Instrument is totally accessible by way of the Ledger Enterprise API. Enterprise prospects can automate their token creation and lifecycle administration processes by means of the API integration, enabling them to simply situation tokenized belongings in excessive volumes at scale.

Auto-Join: Seamless Integration with Ledger Enterprise Platform

Upon accessing Ledger Enterprise Platform, institutional customers can connect with the built-in Token Instrument dApp, eliminating the necessity for handbook pockets connections. This seamless expertise allows customers to provoke their blockchain actions with out further steps.

Auto Swap Community/Deal with: Easy Transitioning Between Accounts

Establishments typically change accounts inside Ledger Enterprise Platform. The built-in Token Instrument dApp streamlines this course of by robotically adjusting to modifications in accounts and networks. This ensures that customers can handle their belongings easily throughout the blockchain ecosystem.

Because the institutional world continues to embrace digital belongings, the necessity for options tailor-made to their particular wants turns into more and more essential. Bitbond and Ledger’s partnership is a pivotal step towards addressing these wants. By offering establishments with a streamlined, user-friendly, and safe technique of managing asset tokenization, this collaboration is poised to reshape the way forward for institutional digital asset administration.Take a look at Token Instrument and take a look at it free of charge on supported testnets.