Fintech is posing an ever-increasing drawback to monetary establishments nonetheless reliant on legacy buildings.

Till now, conventional finance has managed to stave off fintech’s disruptive forces, counting on their a long time of firm to put in belief and an air of stability for the buyer. However there are indicators that that is beginning to change.

“The flexibility to quickly innovate and iterate is quick changing into a aggressive differentiator,” wrote Aite-Novarica Group in a report. “Nonetheless, the demand for innovation poses a big useful resource administration problem. One made worse by monetary establishments’ ongoing reliance on legacy structure and an especially aggressive marketplace for technical workers.”

Banks have, for a while, seen a drain on shopper deposits, and evidently fintechs are making up the distinction. A brand new report by Cornerstone Advisors discovered that to date this yr, fintechs have managed to seize 47% of latest checking account openings.

“Established monetary providers and insurance coverage firms are going through an ideal storm of challenges, together with nimble fintech startups, legacy core platforms that aren’t sufficiently agile to assist trendy imperatives reminiscent of digital transformation, personalization, and speedy utility growth, and strain to modernize core platforms safely and securely,” mentioned Teodor Blidarus, CEO and co-founder, FintechOS.

One strategy might be to companion with fintechs, which may deliver scalability. Nonetheless, it may be a protracted, multi-step course of that requires intensive negotiation and, in some instances, an overhaul of organizational processes to accommodate the brand new addition.

For those who want to proceed in-house, a reevaluation of the core infrastructure is essential to sustaining revolutionary prowess.

Legacy Programs Alternative: the silver bullet?

The legacy techniques of those establishments pose a big difficulty when competing with fintechs. Outdated code and layers of the community create friction, a key drawback when competing with fintechs which may shortly evolve to fulfill shopper wants.

Based on Capgemini in its World Retail Banking Report 2022, “Structural challenges maintain most banks from absolutely leveraging data-driven analytics to draw clients and develop relationships.”

In response to Capgemini’s survey, 95% of monetary establishments mentioned outdated legacy techniques and core banking modules inhibit efforts to optimize data- and customer-centric development methods. As well as, 80% agreed that underdeveloped knowledge capabilities hinder buyer lifecycle course of enhancements. Over two-thirds mentioned they’ve difficulties figuring out new buyer segments, and half reported problem in offering seamless onboarding experiences.

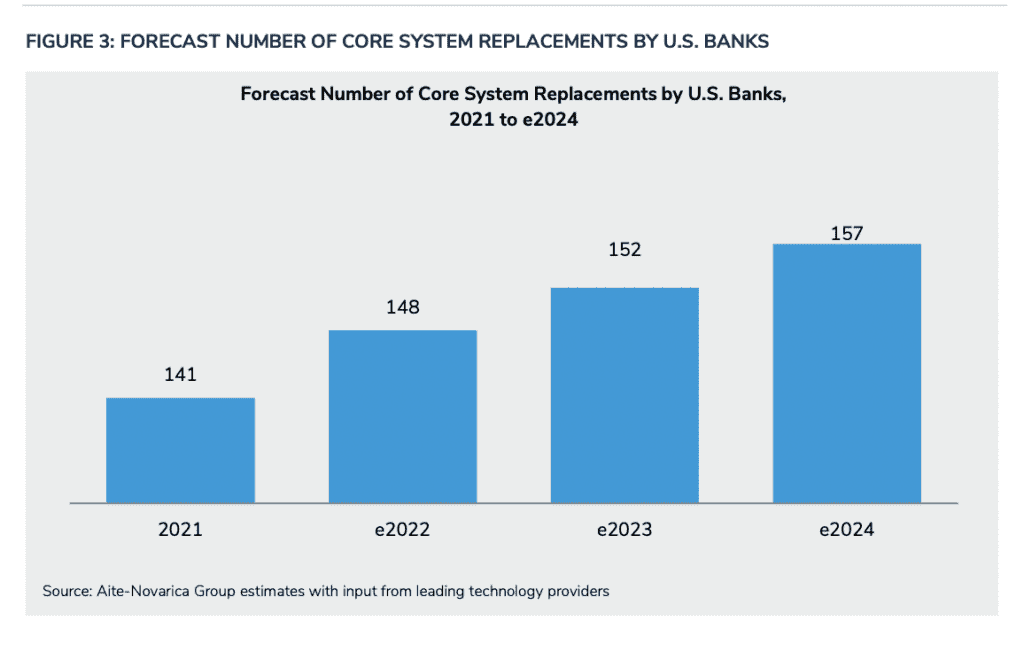

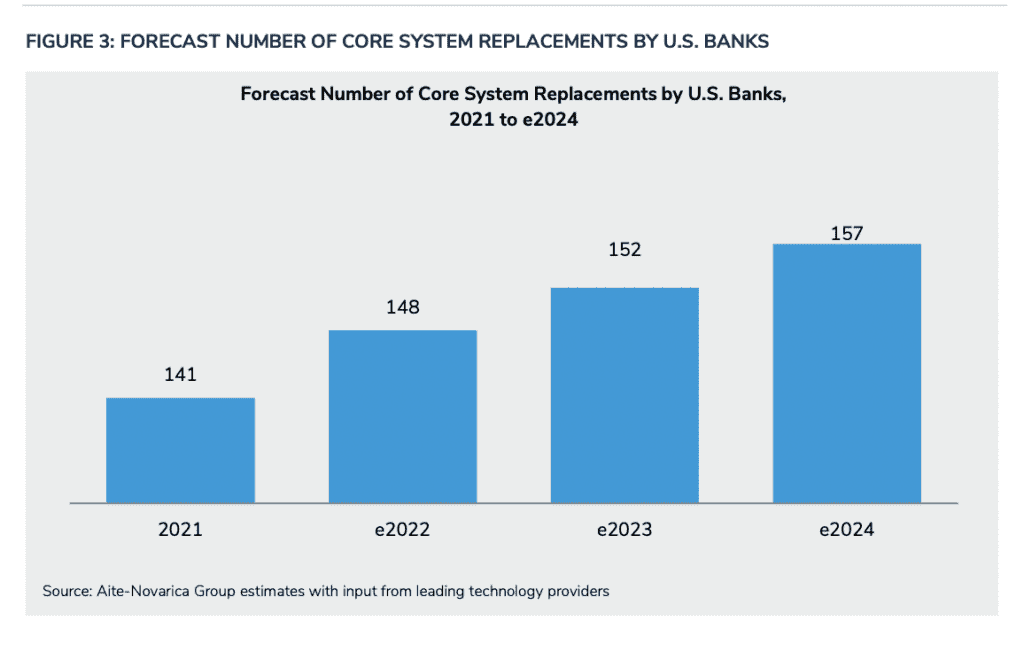

A solution to the problems with core buildings can be to “simply” substitute them. Core system replacements are rising annually, however in line with McKinsey, solely 30% succeed.

The change requires vital useful resource allocation, and because of the complexity, essential parts are sometimes ignored.

“Particularly, core modernization applications that inadequately plan for connectivity and interoperability throughout the financial institution stack decrease their effectivity and effectiveness in driving innovation. This notably contains connectivity to more and more vital third-party fintech ecosystems, in addition to the essential buyer engagement layers that each one FIs depend on,” wrote Aite Novarica.

Nonetheless, the train is unavoidable, and as know-how growth speeds on, core structure stays additional and additional behind.

“Now’s the time for banks to modernize core banking,” says Jerry Silva, vp of IDC Monetary Insights’ Worldwide Banking Digital Transformation Methods program. “Between trendy know-how approaches like microservices and APIs and using cloud platforms making certain scalability and resiliency for the financial institution’s again workplace, banks would do effectively to begin the journey to core system modernizations at once.”

So what’s the answer?

Every core system is, sadly, distinctive, which means the technique needs to be custom-made.

Based on Aite Novarica, At present, there are three basic approaches, every with its personal challenges:

“1 – Full “rip-and-replace” of current core infrastructure: Large-bang approaches to core substitute can successfully deploy new trendy capabilities however are intensive, resource-heavy initiatives with very excessive ranges of danger. This contains the potential for initiatives to spiral out in price and timescale and as threats to service ranges for current purchasers.

2 – Greenfield launch: Sometimes involving cloud-based platforms, these rollouts contain FIs operating a greenfield tech stack that operates parallel to current financial institution infrastructure. New purchasers are onboarded into the greenfield core, whereas older purchasers are later migrated to the brand new platform. This strategy can result in vital disruption for current purchasers and requires a expensive doubling of sources on account of operating parallel operations.

3 – Wrap-around, or core-hollowing: This strategy sometimes makes use of containerized techniques, or a microservices strategy, to deploy trendy capabilities piece by piece, with the choice of outright core substitute in some unspecified time in the future. Whereas dangers are lowered, this strategy requires supporting a viable legacy core system for a number of years, lengthening the time for the general core modernization course of. Moreover, FIs should prioritize areas for modernization, they usually incur dangers on account of vital customization, creating new types of legacy know-how issues.”

Nonetheless, new options are being developed.

RELATED: Generative AI in fintech goes far past the ChatBot

One many are turning to is using fintech enablement methods.

A fintech enablement platform is an infrastructure that acts as an working system for innovation. Decreasing the complexity of launching revolutionary initiatives, it’s made up of prebuilt and modifiable elements many instances utilizing low-code approaches. These will be deployed in a extra agile and responsive methodology than most conventional growth cycles.

Whereas it isn’t an answer to the tangled net of core infrastructure, it may well present a extra streamlined strategy to innovation.