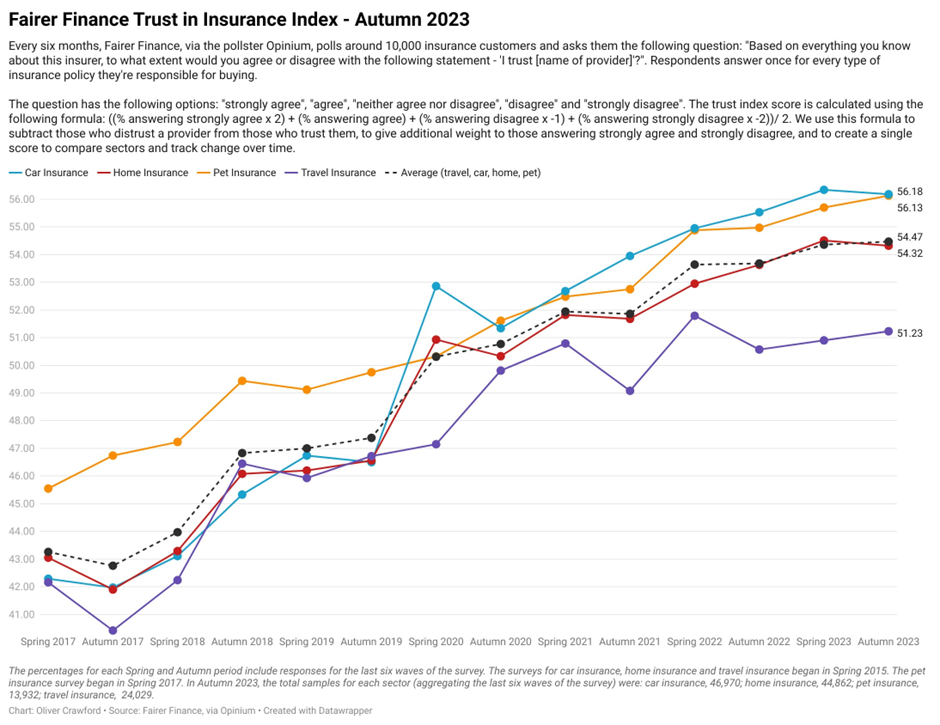

The newest Fairer Finance Belief in Insurance coverage Index reveals that client belief in insurers has levelled off and already exhibits indicators of declining within the automobile insurance coverage sector.

Within the second half of 2023, client belief in automobile insurers dipped for the primary time in three years as insurance coverage premiums rose dramatically. In keeping with Shopper Intelligence, the typical quoted automobile insurance coverage premium rose 61% within the yr to August 2023, with the rise between June and August 2023 being the most important quarterly improve since Shopper Intelligence started gathering this information in 2013.

Fairer Finance’s information, primarily based on insights from a ballot of 10,000 customers, exhibits that worth is probably the most cited cause for buyer dissatisfaction in automobile insurance coverage (52% of sad prospects give this a cause for his or her dissatisfaction). If prospects really feel that worth rises are extreme, they’re more likely to lose belief of their supplier.

A second issue that may very well be eroding belief in automobile insurance coverage is the claims course of. Whereas the overwhelming majority of claims are paid in automobile insurance coverage (99% of claims regarding automobile insurance coverage have been accepted in H2 2021), many customers are sad with the claims’ course of. Fairer Finance information exhibits {that a} quarter (25%) of sad automobile insurance coverage prospects cite problem in managing a declare as their cause for dissatisfaction.

Moreover, information from the Monetary Ombudsman Service (FOS) exhibits that the variety of complaints referred to them regarding automobile and motorcycle insurance coverage rose 50% between Q1 2022 and Q1 2023 and the complaints that elevated probably the most have been these regarding delays in settling claims, which elevated 90% yr on yr.

James Daley, Managing Director at Fairer Finance, the patron group and rankings supplier, commented: “The rising price of claims, falling competitors available in the market and new regulation have all contributed to the steep upturn in the price of automobile insurance coverage within the final yr. This coupled with rising complaints from customers with regards to the claims course of has created the proper storm for the erosion in belief of insurers. Whereas worth throughout a cost-of-living disaster is vital to customers, so too is their perceived worth for cash and model reputations which are certified by way of their buyer expertise journey and high quality of claims course of.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

View profiles in retailer

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

helpful

determination for your corporation, so we provide a free pattern which you can obtain by

submitting the beneath kind

By GlobalData

“We’ve additionally witnessed an inflow of latest sub-brands launched into the automobile insurance coverage market – a apply generally known as model stacking – which I imagine has been a direct results of new regulation that bans insurers from providing completely different costs to new and current prospects. The difficulty is that many customers is not going to perceive the variations between the assorted tiers of insurance policies, doubtlessly choosing a less expensive, low-level coverage that now excludes parts that till now have been fairly common in a “complete” coverage. It’s solely once they come to say that this may occasionally turn out to be obvious and can little question lead to an increase in buyer misbuying and an additional fall in belief within the close to future.”

Trusted automobile Insurers

Monitoring customers’ views twice yearly over the past six years, that is the one index that tracks ranges of belief throughout dwelling, automobile, journey and pet insurance coverage. The information exhibits that probably the most trusted automobile insurance coverage suppliers in H2 2023 are NFU Mutual, BMW and John Lewis, whereas the least trusted are Price range, One Name Insurance coverage and Zenith Insurance coverage.

Youthful drivers (18-30 years) have barely larger charges of belief than older age teams – which is considerably shocking given they often pay larger premiums. Those that have made a declare within the final three years are extra trusting than those that haven’t, doubtlessly as a result of most claims are accepted in automobile insurance coverage, so those that have claimed will in all probability have had their declare authorised and due to this fact belief their insurer extra primarily based on that optimistic expertise.

One attribute that extremely trusted automobile insurers have in widespread is that their manufacturers have robust reputations. Within the Fairer Finance polling, it asks respondents why they selected their automobile insurance coverage supplier – one of many choices is ‘The model’s status’. There’s a robust correlation (0.75) between the proportion of respondents who ‘strongly agree’ that they belief their supplier and the proportion saying they selected their supplier due to its good status.

Conversely, there’s a average adverse correlation (-0.61) between the proportion of shoppers who strongly belief a supplier and the proportion saying they selected the supplier as a result of it was the most cost effective on a comparability website. This implies that manufacturers which compete extra on worth than on service could also be seen as much less reliable.

General, throughout the final insurance coverage sector, belief has levelled out. Now that belief in automobile insurers has dipped, it’s on the identical degree as belief in pet insurance coverage suppliers, adopted by dwelling insurance coverage after which journey insurance coverage, which remains to be the least trusted sector (though it has seen an upturn within the final yr).

COP28 podcast: max 1.5°C temperature rise restrict now ‘not doable’